Mining

Tuesday, August 16th, 2022 8:28 am EDT

Nyrstar did not specify the factors behind the decision, but a source close to the situation said electricity costs have increased by as much as 10 times while labor, freight, and other costs also have increased.

Budel’s nameplate capacity is [315ktpa] of zinc, but the smelter has been operating at reduced capacity since Q4 2021.

The company had already cut output by up to 50% at its three European zinc smelters while Glencore warned this month that “the current energy supply and price environment poses a significant threat.”

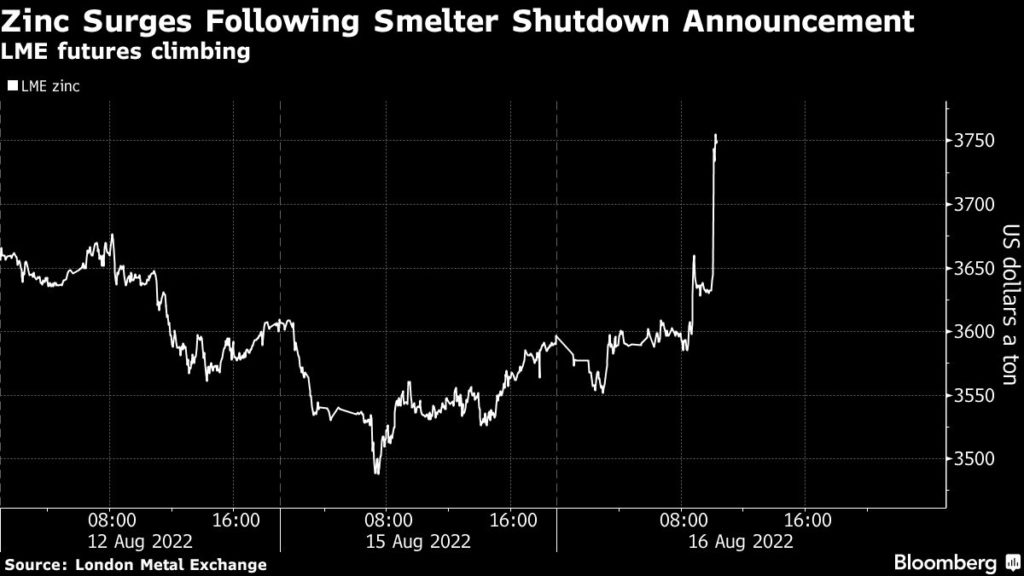

Benchmark zinc on the London Metal Exchange jumped 6.6% to $3,797.50 a tonne, the highest since June 9.

Click here for an interactive zinc price chart.

Industries from fertilizer to aluminum are being crippled by soaring energy costs as Russia squeezes gas flows to Europe following its invasion of Ukraine. On Tuesday, benchmark power prices surged to a fresh record as the worst energy crisis in decades looks set to persist well into next year.

“That theme is ongoing due to tightness in the electricity and power market in Europe,” said Xiao Fu, head of commodity market strategy at Bank of China International.

“Market inventories have fallen to very low levels and we would expect stocks to continue to fall in Europe.”

Low water levels on the Rhine were an added concern, she said.

Dutch gas for September hit the highest levels since March this week, boosted by hot weather in Europe.

“There will be a bit of capacity juggling going on,” said Tom Price, an analyst at Liberum Capital.

“If the EU needs their metal, they will probably have to import more semi-refined material or the metal itself.”

Citi upgraded its zinc price forecast for the next three months on Monday to $3,200/tonne from $2,800/tonne, saying it expected concern about an economic downturn would weigh on all base metals prices, but zinc would outperform.

“We project greater forecast cuts to European zinc smelter output as winter power shortages play out,” Citi said in a note.

(With files from Reuters and Bloomberg)

This post has been syndicated from a third-party source. View the original article here.