US Markets

Monday, June 17th, 2024 2:29 pm EDT

Key Points

- Recent Sale and Stake Reduction: Berkshire Hathaway sold an additional 1.3 million Hong Kong-listed shares of BYD for $39.8 million, reducing its stake in the company from 7% to 6.9%.

- Lucrative Investment History: Berkshire initially purchased about 225 million shares of BYD in 2008 for around $230 million. This investment has been highly profitable due to the significant growth of the EV market, with BYD’s stock price increasing nearly 600% by April 2022.

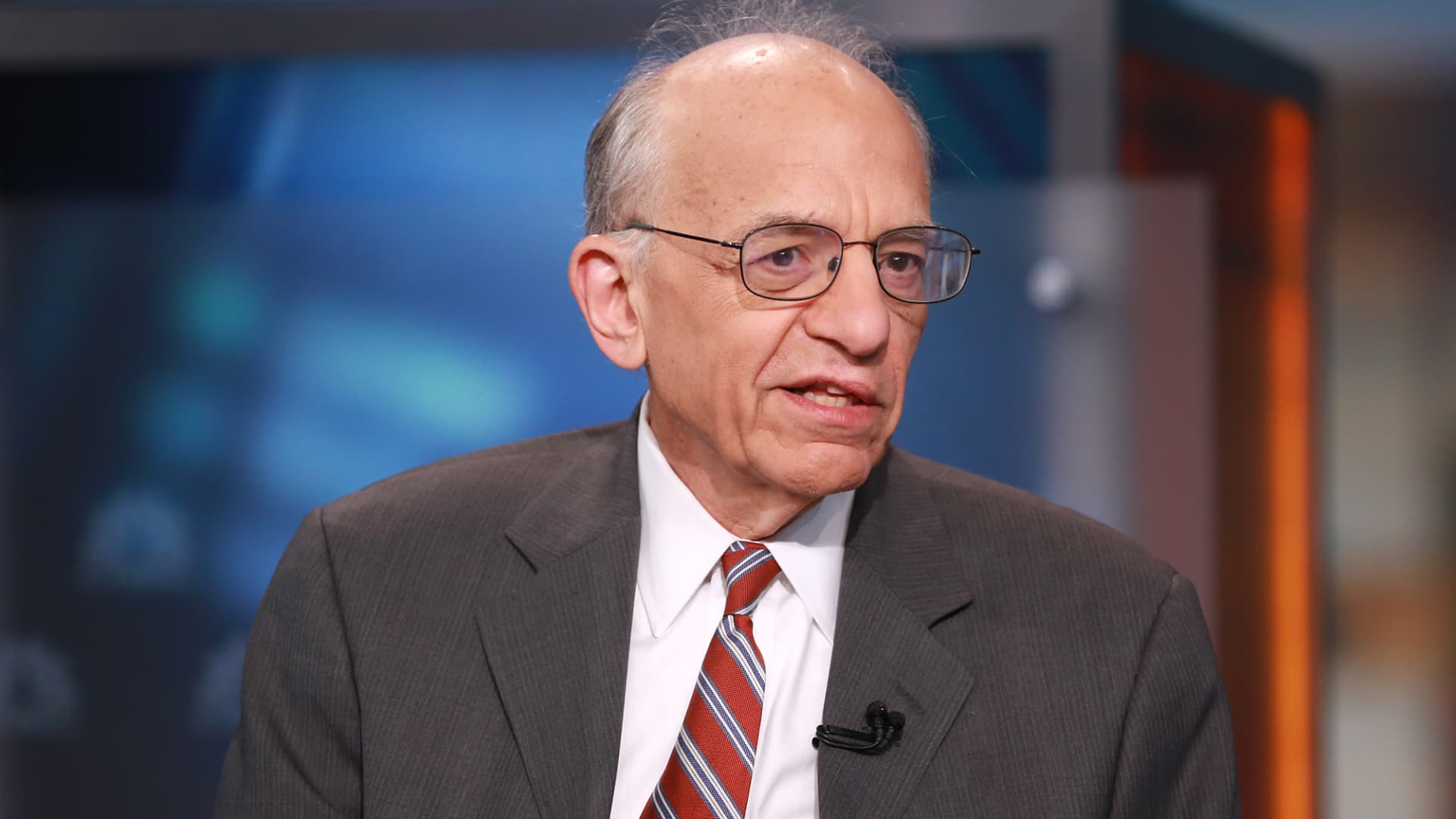

- Munger’s Influence: The decision to invest in BYD is credited to Charlie Munger, Berkshire’s late vice chairman, who was introduced to the company by his friend Li Lu. Munger played a pivotal role in recognizing BYD’s potential, leading to Berkshire’s early and successful investment.

Berkshire Hathaway, guided by the investment acumen of the late Charlie Munger, has continued to reduce its substantial investment in BYD, China’s leading electric vehicle (EV) manufacturer. In a recent transaction, Warren Buffett’s conglomerate sold an additional 1.3 million Hong Kong-listed shares of BYD for $39.8 million, as disclosed in a filing to the Hong Kong Stock Exchange. This sale decreased Berkshire’s ownership in BYD from 7% to 6.9%. Berkshire’s initial foray into BYD occurred in 2008 when it acquired about 225 million shares of the Shenzhen-based company for roughly $230 million. This investment proved to be highly profitable, thanks to the explosive growth of the EV market in China and globally.

Over the years, Berkshire has been systematically reducing its stake, selling off half of its holdings in 2022 and 2023. This decision followed the dramatic rise in BYD’s stock price, which surged nearly 600% from the start of 2008 to a record high in April 2022. Hong Kong’s regulatory requirements necessitate public disclosures only when a shareholder’s stake crosses a whole number percentage, meaning another filing will be required if Berkshire’s stake drops below 6%.

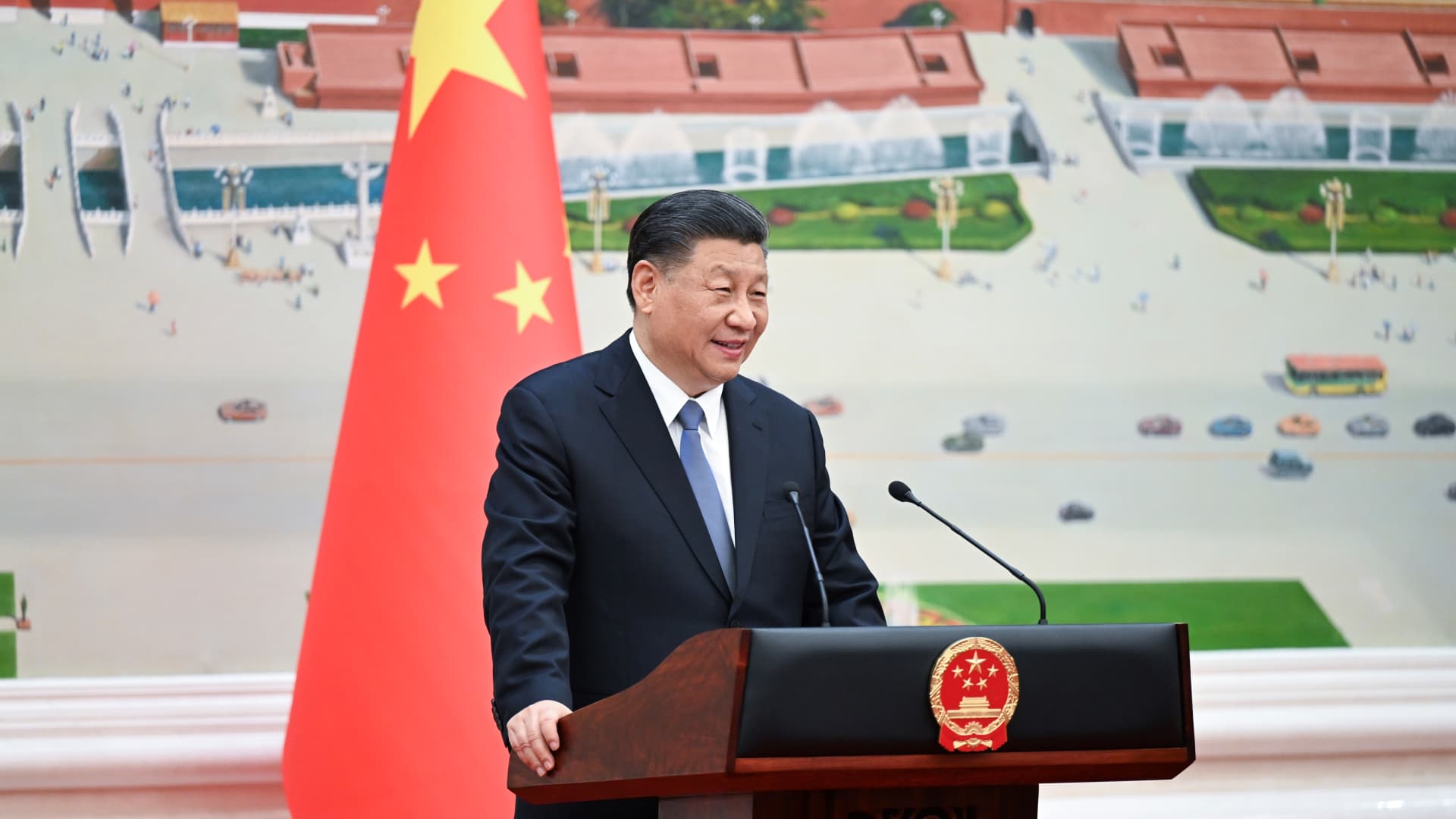

The success of Berkshire’s investment in BYD is largely attributed to Munger’s influence. BYD, founded by Wang Chuanfu, initially started as a manufacturer of batteries for mobile phones in the 1990s. By 2003, the company had shifted its focus to the automotive industry, eventually emerging as the leading car brand in China and a significant player in the EV battery market. In the fourth quarter of 2023, BYD surpassed Tesla to become the world’s top EV maker, selling more battery-powered vehicles than its American competitor.

Buffett has publicly acknowledged that Munger, who served as Berkshire’s vice chairman, was instrumental in the decision to invest in BYD. Munger was introduced to the company by Li Lu, a friend and the founder of Seattle-based asset manager Himalaya Capital. Buffett credited Munger with 100 percent of the decision to invest in BYD, highlighting Munger’s critical role in this highly successful investment.

For the full original article on CNBC, please click here: https://www.cnbc.com/2024/06/17/warren-buffetts-berkshire-hathaway-trims-its-stake-in-chinese-ev-maker-byd-to-6point9percent.html