Mining

Tuesday, June 28th, 2022 2:44 pm EDT

The average mill throughput is expected to increase to 2,400 tonnes per day from 2,000 tonnes per day, while the mine life is estimated to increase to 18 years from 16 in the previous study. The project’s capital expenditure has been pegged at $756 million, up from $538 million.

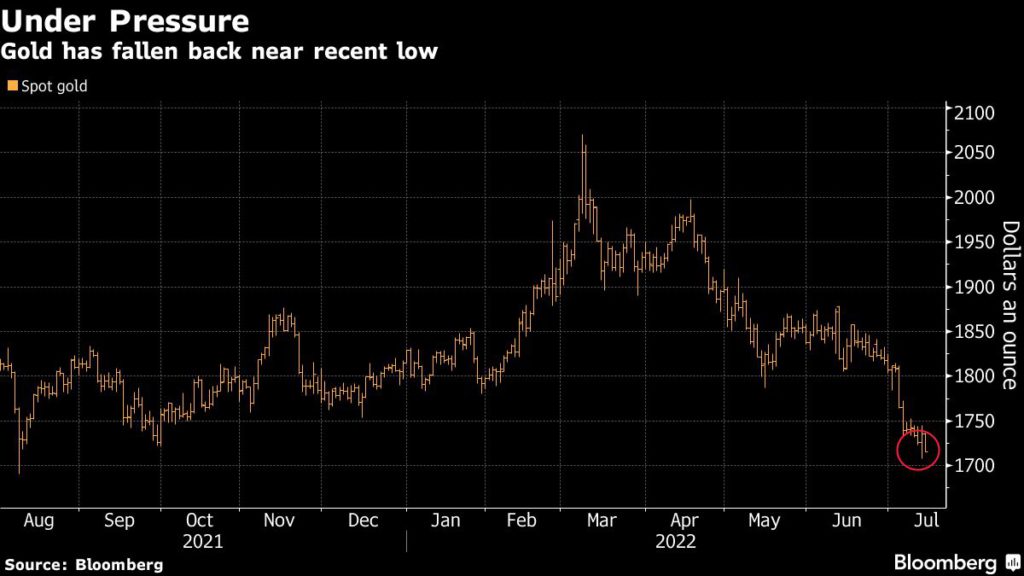

At a 5% discount rate, the phase 3+ study forecasts the project will generate a post-tax net present value of $2 billion, compared to $1.5 billion previously. The post-tax internal rate of return is now estimated at 25%, compared to 22%, using a metal price of $1,850 per oz. gold.

“This is going to be one of the largest and most profitable gold mines in Canada. In terms of scale, it will rank as the seventh largest gold producer in Canada,” John McCluskey, Alamos Gold’s CEO, told The Northern Miner.

“It will be the lowest cost gold mine in Canada and one of the top five most profitable in Canada. At 18 years, Island Gold’s mine life will be one of the longest life operations in Canada,” he added.

Located about 80 km northeast of Wawa, near the town of Dubreuilville, the Island Gold underground operation began production in 2007 under previous owners, before Alamos acquired it in 2017.

Alamos increased the mine’s mill throughput in two phases, from 900 tonnes per day to its current 1,250 tonnes daily. Key changes in the latest phase will include the addition of 1.4 million oz. to the reserve and resource base, the installation of a shaft and paste plant, and an expansion of the mill.

“The chief advantage of a shaft is it keeps costs stable over the life of the mine, whereas with a ramp operation the costs increase as the mine deepens,” McCluskey explained.

“We announced a shaft expansion as part of our positive Phase 3 expansion study in 2020. This followed a detailed evaluation of several scenarios which demonstrated the shaft expansion as the best option, having the strongest economics, being the most efficient and productive scenario,” he added.

The addition of a shaft will also reduce the company’s usage of diesel haul trucks from 18 to five, which in turn will reduce greenhouse gas emissions by about 35% over the life of the mine, the CEO said.

While the latest study carries a higher capital cost, McCluskey believes the cost is worth it as the expansion is likely to make it a better operating mine. In addition, its all-in sustaining costs are expected to decrease by more than 30% to about $586 an ounce.

“If gold prices were to be cut in half, Island Gold would be one of the few Canadian gold mines that would still be very profitable. Conversely, with higher throughput rates, we are well positioned to be able to generate even higher revenue in a rising gold price environment,” said McCluskey.

Aside from Island, Alamos Gold also owns the Young-Davidson mine in Ontario and Mulatos mine in Mexico, which produced 195,000 oz. gold and 121,300 oz. gold in 2021, respectively.

“With three operating mines with long-life operations we have the capacity to produce over 600,000 oz. a year, in addition to the Lynn Lake development project in Manitoba,” said McCluskey.

This post has been syndicated from a third-party source. View the original article here.