Technology

Sunday, September 11th, 2022 8:55 pm EDT

BEIJING — When it comes to futuristic concepts like the metaverse, JPMorgan analysts think they’ve found a strategy for selecting Chinese stock plays.

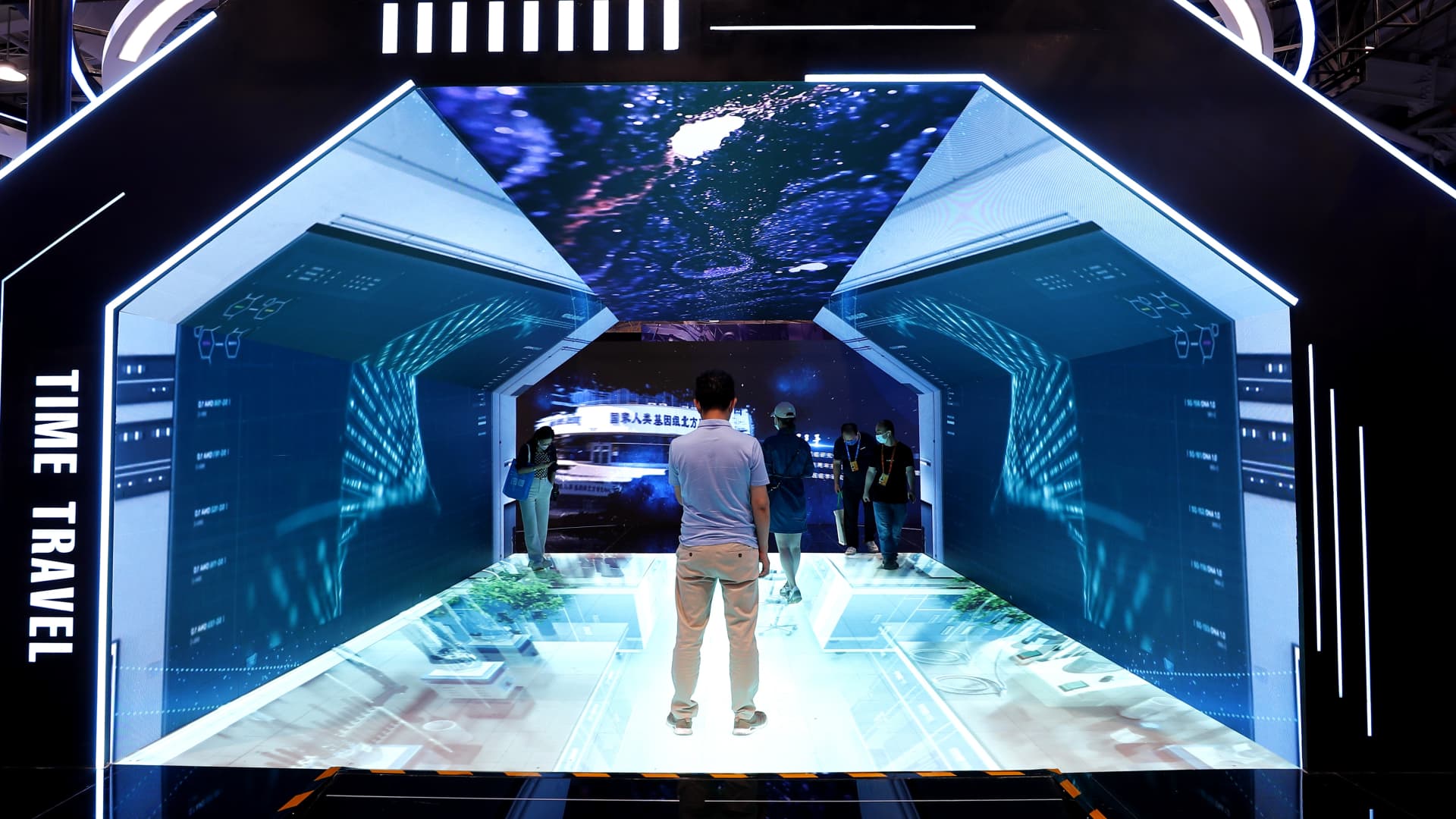

The metaverse is loosely defined as the next iteration of the internet, existing as a virtual world in which humans interact via three-dimensional avatars. Hype around the metaverse swept through the business industry about a year ago. But in the United States at least, it isn’t gaining the momentum that companies such as Facebook had hoped.

The social network giant even changed its name to Meta last year. However, its shares are down more than 50% this year — far worse than the Nasdaq’s roughly 24% decline.

China faces the same consumer adoption problems as the United States. But the Asian country’s metaverse development faces its own challenge of regulatory scrutiny, something the JPMorgan analysts pointed out in their Sept. 7 report. Cryptocurrencies, a major element of the metaverse outside China, are also banned within the country.

Nevertheless, the stock analysts said some Chinese internet companies can make money from particular industry trends driven by the metaverse’s development.

Top picks

Their top picks in the sector are Tencent, NetEase and Bilibili. And among non-internet names in Asia, companies like Agora, China Mobile and Sony made JPMorgan’s list of potential beneficiaries.

That’s based on the companies’ competitive edge in particular aspects of the metaverse, such as gaming and social networks.

“Development of mobile internet and AI in the past 5-10 years suggests that a company’s competitive advantage in one part of the tech ecosystem is often more important in determining long-term value creation to shareholders than which part of the ecosystem the company operates in,” analyst Daniel Chen and his team said in the report.

Here are two main ways that companies can make money as the metaverse develops, the analysts said.

Gaming and intellectual property

In JPMorgan’s most optimistic scenario, China’s online game market nearly triples to $131 billion from $44 billion.

Tencent and NetEase both have strong gaming businesses and partnerships with global industry leaders, the analysts said.

For example, Tencent has a stake in virtual world game company Roblox, while NetEase has partnered with Warner Bros. for a Harry Potter-themed mobile game, the report pointed out.

Digitalization of business and consumption

“The metaverse will likely double digital time spent” from the current average of 6.6 hours, the analysts said. They also expect companies will be able to generate more revenue per internet user.

JPMorgan estimates the total addressable market in China for business services and software in the metaverse will be $27 billion, while digitalizing the offline consumption of goods and services will make up a $4 trillion market in China.

In business services, NetEase already has a virtual meeting room system called Yaotai, while Tencent operates a videoconferencing app called Tencent Meeting, the report pointed out.

Tencent also has “rich experience in managing China’s largest social network Weixin/mobile QQ” and can benefit from virtual item sales within those platforms, the analysts said.

Similarly, Bilibili’s “high user engagement will enable it to capture rich monetization potential in [value added service]/virtual item sales in the long run,” the analysts said.

They noted the app is the “go-to entertainment platform” for Chinese people aged 35 and below, with each user spending an average of 95 minutes a day on the platform in the first quarter.

While the central Chinese government has cracked down on prolonged gaming by minors, some local authorities have announced plans for metaverse development.

‘Obstacles to overcome’

But it remains unclear how practical such efforts will be from a business perspective.

Without naming the companies as stock picks, the JPMorgan analysts described a number of other metaverse projects underway in China, such as Baidu’s virtual XiRang world, and virtual reality development by Baidu-backed iQiyi, NetEase and Bilibili.

The analysts said virtual reality devices are currently too heavy to be used for long periods of time, and cloud computing capabilities and metaverse content remain limited.

“We think ‘perfect form’ of the metaverse could take decades to achieve,” the analysts said. “While we believe the [total addressable market] for the metaverse is enormous, we believe there are various technological obstacles to overcome.”

— CNBC’s Michael Bloom contributed to this report.

This post has been syndicated from a third-party source. View the original article here.