US Markets

Monday, July 25th, 2022 1:23 pm EDT

U.S. equities wavered Monday, as traders braced for the busiest week of corporate earnings, as well as a likely rate hike from the Federal Reserve.

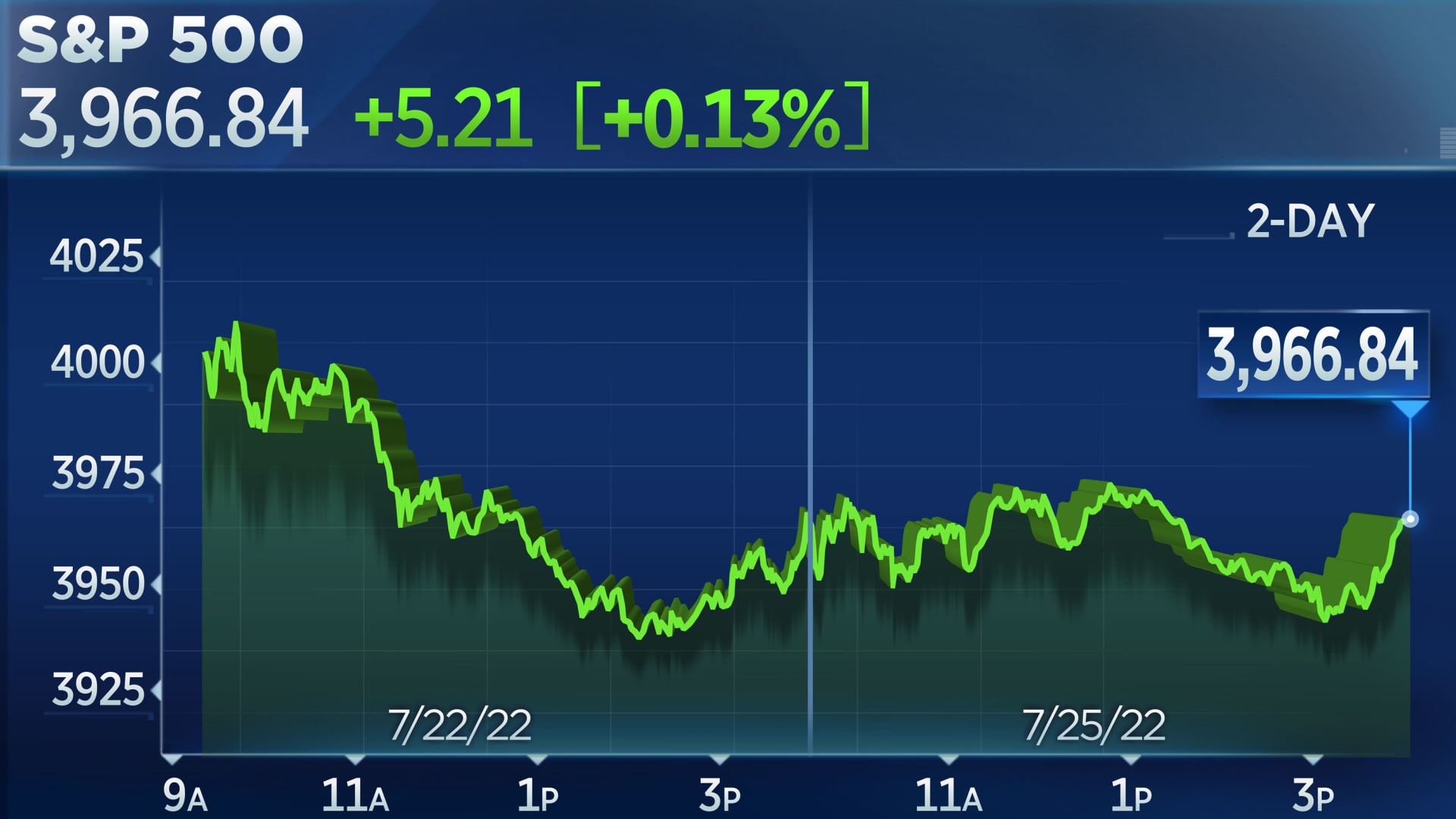

The S&P 500 added 0.1%, closing at 3,966.84. The Dow Jones Industrial Average climbed 90.75 points, or 0.3%, to 31,990.04. The tech-heavy Nasdaq Composite lagged, sliding 0.4% to 11,782.67. All of the major averages are on track for their best month of the year.

Monday kicked off the final week of trading for the month of July — and perhaps the most important week of the summer — with the Fed meeting and GDP data on deck. Almost a third of the S&P 500 are set to report quarterly earnings this week as well, including Apple, Alphabet and Microsoft. This all comes as investors fret about the potential of an economic recession.

“Investors likely believe Thursday’s GDP report will show a second quarter of decline, which is the unofficial signal of recession,” Sam Stovall, chief investment strategist at CFRA Research, told CNBC on Monday. “While the Fed will probably announce a 75-basis-point rate hike on Wednesday, they will offer a more moderate tone towards further rate increases. We see this counter-trend rally continuing in the near term.”

Tech stocks fell Monday on the heels of a warning by Snap, which reported disappointing earnings last week causing investors to worry about declining digital ad spending in the current economic climate. Meta Platforms dropped 1.5%, and Amazon slipped by 1.1%. Apple, Microsoft and Alphabet ended slightly lower.

Elsewhere, shares of Newmont Corporation slid 13.2% after the mining company reported a quarterly loss that was down nearly 41% from a year ago, hurt by a drop in gold prices. Philips tumbled 7.2% after the Dutch medical equipment maker reported weaker-than-expected quarterly earnings, citing lockdowns in China and supply chain issues.

On the flip side, energy stocks were the best performing sector as oil prices rose. Marathon Oil and APA Corp each jumped about more than 6%. Diamondback Energy, Occidental Petroleum, Devon Energy and Valero gained about 5% each. Chevron was the top gainer in the Dow, up nearly 3%.

Loading chart…

The major averages are going for their third positive week in four. The S&P 500 has been attempting a comeback after falling into a bear market earlier this year. The index currently sits 9% from its 2022 low.

Investors shifted into risk assets last week after absorbing some strong corporate results that had Wall Street deliberating whether the bear market has found a bottom.

“Sometimes you have to remove emotion from markets and focus on the technicals,” said Jeff Kilburg, chief investment officer and portfolio manager of Sanctuary Wealth. He noted that S&P 500 traded above its 50-day moving average last week and that he saw a bottom for the index at 3,600.

“Seven percent ago … we had so much emotion, peak inflation, the CPI reading, peak pessimism, downgrades from Morgan Stanley and Bank of America, everyone pulling down their end-of-year targets,” he added. “When you see that many people listen to one side of the boat, markets go the other way.”

This post has been syndicated from a third-party source. View the original article here.