Mining

Monday, July 11th, 2022 3:01 pm EDT

“KSM is the largest undeveloped gold-copper project in the world by resources,” Brent Murphy, Seabridge’s senior vice president of environmental affairs, told BIV News.

Seabridge has already spent C$480 million to move the KSM project through exploration, engineering and environmental permitting.

Earlier this year, Seabridge raised C$285 million through Sprott Resource Streaming and Royalty Corp. and the Ontario Teachers’ Pension Plan, and signed a power agreement with BC Hydro to supply the new mine with power.

Work is now underway to build a power substation that will provide the mine site with up to 250 megawatts of power from the Northwest Transmission Line. Construction of a new power transmission line to tie into the Northwest Transmission line is expected to begin next year.

Seabridge plans to spend C$150 million this year on infrastructure needed to prepare the new mine for development, and as much again next year. That includes things like building road access, work camps and a new bridge. Across the Bell Irving River. About 150 workers are currently employed.

“By the end of this year, we will probably have spent close to C$600 million on KSM,” Murphy said.

Some of the work going on now also includes fish habitat compensation work.

“These projects are designed to compensate for the impacts of building and bridge crossings on fish habitat,” Murphy said.

The work taking place this year and next is required by a provincial environmental certificate, approved in 2014, as it requires a substantial start on the project within a specified time period. Some of that work was delayed by the covid-19 pandemic, something acknowledged by the BC Environmental Assessment Office, which issued the company a two-year extension.

“The work is also designed to further de-risk the project further and make it more attractive to securing a joint venture partner,” Murphy said.

“Seabridge would not take this project through to full construction and start the mining operations. That’s not our strength. We are looking for a major mining company that has both the technical, financial and social sustainability wherewithal to operate this project from both an environmental and socially responsible mind-set.

“Seabridge is really good at de-risking projects, but our strength is not in operating projects.”

The KSM project (short for Kerr-Sulphurets-Mitchell) has been more than 20 years in the making. Seabridge bought the original claims from Placer Dome in 2000. Since then, additional deposits were discovered and added – the Mitchell deposit in 2007, Iron Cap in 2010, and East Mitchell in 2020.

It took nearly seven years for the KSM project to go through a federal-provincial environmental review process. Much has changed since the project received its environmental certificate in 2014. Initially, the proposal was to develop four distinct deposits of gold, copper, silver and molybdenum in a complex of open-pit and underground mines.

“We’re now focused primarily on an open pit mining approach on the deposits,” Murphy said. “We’re deferring any underground mining to a later date. The reason we’re focusing on open-pit mining is we’re simply trying to drive the best economics for the project.”

The mine site would be connected to a tailings facility some 23 kilometres away by a twin tunnel.

In 2014, KSM’s resources were estimated at 38.2 million ounces of gold and 9.9 billion pounds of copper. An updated estimate on proven and probable gold reserves has increased gold reserves by 22%, to 47.3 million ounces, due to higher gold grades from the East Mitchell deposit.

But the mine’s copper reserves have decreased to 7.3 billion pounds, and silver reduced to from 180 million ounces to 160 million ounces. That’s partly due to a change in the mining plans, which includes eliminating underground mining for deposits that are more copper-rich.

“We’re eliminating the underground operations in Iron Cap and Kerr, and hence why our drop in copper,” Murphy explained.

The project’s original estimated total capital cost — both initial and sustaining – has dropped from $10.5 billion to $9.6 billion.

“However, our initial capital has increased from $5 billion to $6.4 billion, primarily due to inflation,” Murphy said.

Seabridge has also increased its estimated annual production, which would shorten the mine’s life. Since the project was approved in 2014, Seabridge has increased its expected annual production of gold by 90%, copper by 22%, and silver by 36%. It plans to increase the mine’s mill throughput from 130,000 tonnes per day to 195,000 tonnes per day.

The increased throughput would reduce the mine life from 53 years to 33 years. As a result of the increased production volumes, Seabridge now estimates the payback period will decrease from 6.8 years to 3.7 years.

The company estimates building the mine would take a workforce of 1,550 annually over a five-year construction phase, and 1,400 jobs ongoing once in production. Seabridge has signed benefits agreements with the Nisga’a and Tahltan First Nations.

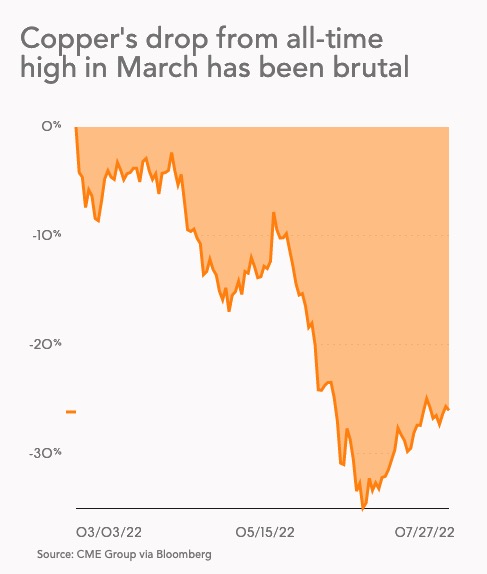

Seabridge’s stock value has dropped by more than 40% since mid-April, falling from C$27.05 per share April 14 to Monday’s price of C$14.81.

It appears to be part of a sector-wide decrease, as other gold companies, like Barrick Gold (TSX:ABX) and Newmont Gold (TSX:NGT), have likewise seen a steady declines in stock prices since mid-April. Market-watchers blame increasing U.S. treasury yields for the general decline in gold company stocks.

(This article first appeared in Business in Vancouver)

This post has been syndicated from a third-party source. View the original article here.