US Markets

Saturday, June 18th, 2022 6:40 am EDT

Wall Street and the Federal Reserve appeared to enter a new reality this week, and the result for investors was big losses with no obvious end point in sight.

The S&P 500 posted its 10th down week in the last 11, and is now well into a bear market. On Thursday, all 11 of its sectors closed more than 10% below their recent highs. The Dow Jones Industrial Average fell below 30,000 for the first time since January 2021 this past week.

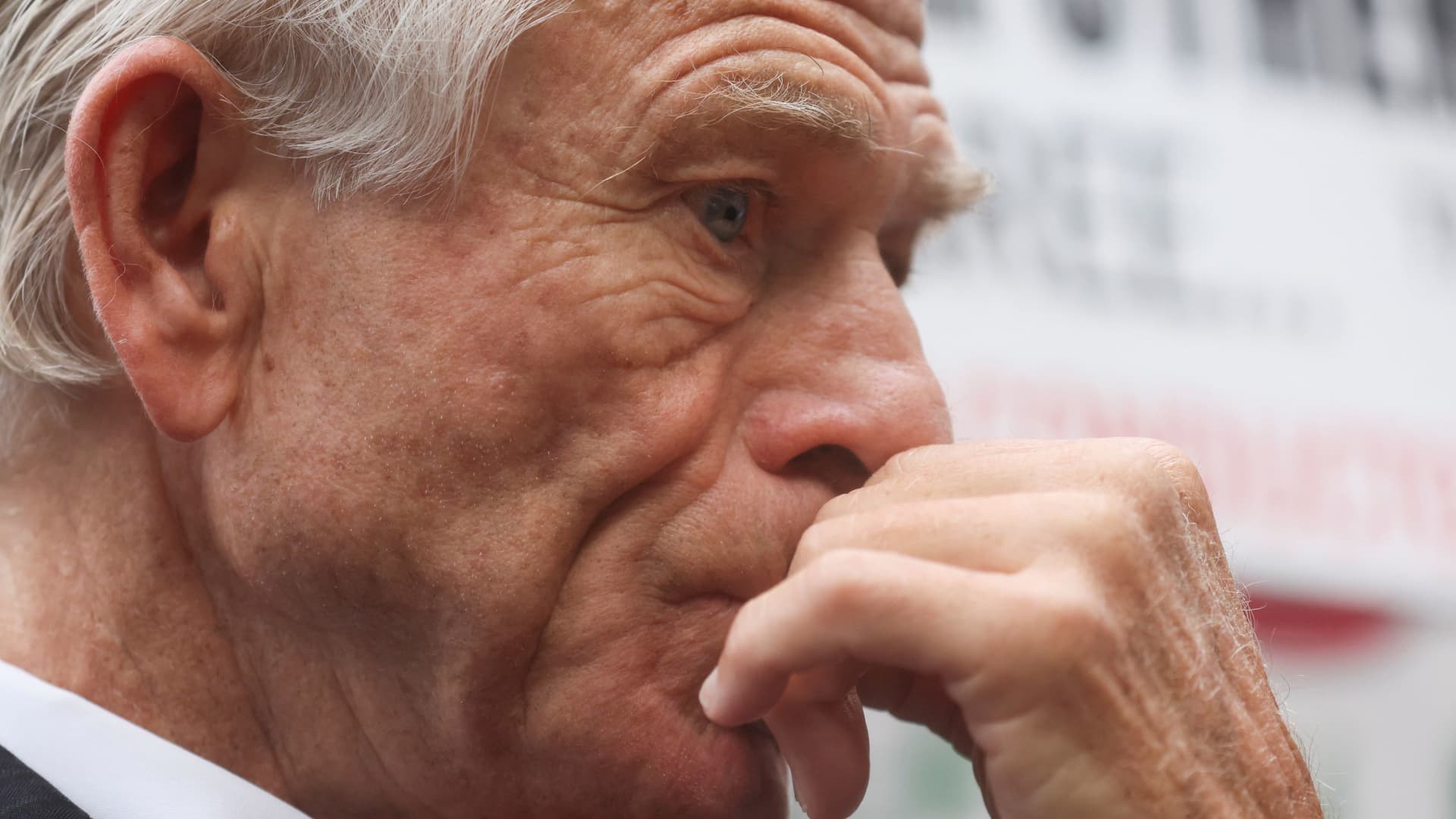

Unlike recent drawdowns for stocks, however, the central bank will not be putting a bottom in the market. Instead, the Fed raised interest rates by three-quarters of a percentage point on Wednesday — its biggest since 1994 — and signaled continued tightening ahead. Chair Jerome Powell will testify before Congress next week and is expected to hold firm on his plan for a more aggressive Fed until inflation is brought to heel.

Bank of America equity strategist Ajay Singh Kapur said in a note to clients on Friday that it is time for investors to stop fighting the Fed and give up the buy-the-dip mentality.

“In a bear market, heroism is punished. Valor is unnecessary, and cowardice is called for in portfolio construction — that is the way to preserve capital and live to fight another day, waiting for the next central bank panic, and better valuations and a new earnings upcycle,” Kapur wrote.

Tech stocks, which are sensitive to interest rates, have been hit particularly hard, as have cyclical plays such as airlines and cruise lines.

But the dramatic declines have not been limited to stocks. Bitcoin dropped more than 30% in a week amid reports about blowups of crypto-focused trading firms. Treasury yields, which move opposite of bond prices, have spiked.

Markets briefly rallied on Wednesday afternoon after the Fed’s announcement, but that optimism was quickly dashed and the gains reversed on Thursday. Many strategists are warning that markets and sentiment could have further to fall, pointing to Wall Street earnings estimates that curiously still show solid growth in the coming year.

“These people need to fight inflation as fast as possible and as hard as possible. And the market has consistently been behind the curve on trying to understand how aggressive this Fed was going to be,” said Andrew Smith, chief investment strategist at Delos Capital Advisors.

Recession ahead?

The impact of the Fed’s rate hikes on the market has been magnified by deteriorating economic data, as investors and strategists appear to be losing confidence in the central bank’s ability to achieve a soft landing.

The housing market appears to be cooling rapidly, with housing starts and mortgage applications plummeting. Consumer sentiment is plumbing record lows. Jobless claims are beginning to trend higher as reports of layoffs at tech firms grow. And all oil prices show no signs of falling back below $100 per barrel as the summer travel season kicks off.

In a note to clients on Friday, Bank of America global economist Ethan Harris described the U.S. economy as “one revision away from recession.”

“Our worst fears around the Fed have been confirmed: they fell way behind the curve and are now playing a dangerous game of catch up. We look for GDP growth to slow to almost zero, inflation to settle at around 3% and the Fed to hike rates above 4%,” Harris wrote.

Even among more optimistic economists, the outlook calls for a rather bumpy landing. JPMorgan’s Michael Feroli said in a note Friday that he expected Powell to be “largely successful” in balancing fighting inflation with economic growth, but a recession is a distinct possibility.

“This desired soft landing is not guaranteed, and Fed chair Powell himself has noted that achieving this goal may not be entirely straightforward. And with a tight labor market and the economy dealing with the shocks of tighter financial conditions and higher food and energy prices, recession risks are notable as we think about the next few years,” Feroli wrote. “Our models point to 63% chance of recession over the next two years and 81% odds that a recession starts over the next three.”

Coming up

Powell will be in the hot seat again next week, as he returns to Capitol Hill to testify before both houses of Congress, and he is unlikely to soften his stance over the weekend.

The Fed Chair said on Wednesday that he and his committee members were “absolutely determined” to keep inflation expectations from rising. The central bank said in a report to Congress on Friday ahead of the hearings that its commitment to price stability is “unconditional.”

Inflation has risen to a top political issue, as well as an economic one, and the Fed’s raised forecast for unemployment could also come under scrutiny from lawmakers.

“As they’re going to 2.5%, 3.5% [Fed funds rate], if the economy is slowing toward a recession, I don’t think they’re going to stand on the throat of the economy to get inflation to go down,” said Robert Tipp, chief investment strategist for PGIM Fixed Income. “…Otherwise, in order to get inflation down from 3.5% to 2%, you’re going to have to lose your job. That’s going to be the message: We’re going to have to get some job losses and recession. And I don’t think that trade-off is going to be worth it for them.”

On Friday, investors will get an updated consumer sentiment reading from the University of Michigan. That measure has now taken on increased significance after Powell pointed to it this week as one of the reasons the Fed decided to raise its rate hike this month.

The survey’s preliminary reading for June showed a record low for sentiment, and confirmation of that number — or even further deterioration — would likely serve as further proof that the Fed will not waver in the coming months. The inflation expectations part of the survey, which rose in the preliminary reading, will be watched closely.

Outside of those events, next week is relatively light for economic events, with U.S. stock markets closed on Monday for Juneteenth. Investors will be looking for insight into the U.S. economy in earnings reports from a few bellwether stocks, such as Lennar on Tuesday and FedEx on Thursday.

Week ahead calendar

Monday

Earnings: Kanzhun

U.S. stock market closed for Juneteenth

Tuesday

Earnings: Lennar

8:30 a.m. Chicago Fed National Activity Index

10:00 a.m. Existing home sales

Wednesday

Earnings: Korn Ferry, Winnebago

9:30 a.m.: Fed Chair Jerome Powell testifies to the U.S. Senate Banking Committee

Thursday

Earnings: Accenture, FedEx, Darden Restaurants, FactSet Research Systems

8:30 a.m. Jobless claims

10:00 a.m. Fed Chair Jerome Powell testifies to the U.S. House Committee on Financial Services

Friday

Earnings: CarMax

8:00 a.m. Building permits

10:00 a.m. Michigan Sentiment

10:00 a.m. New home sales

This post has been syndicated from a third-party source. View the original article here.