Mining

Friday, June 17th, 2022 7:59 am EDT

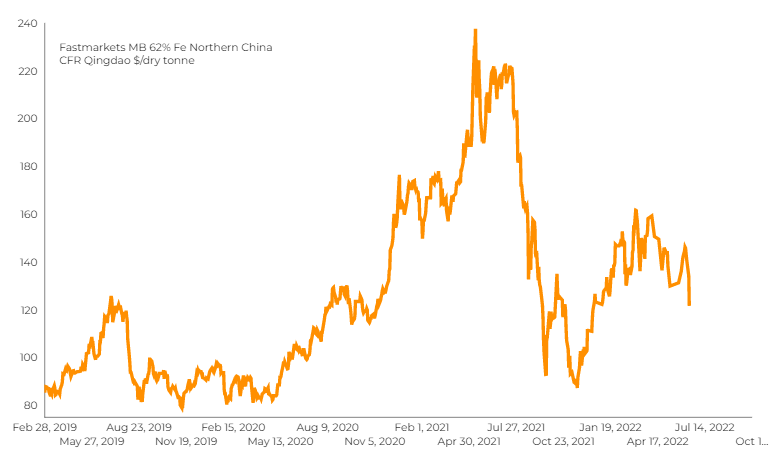

The most-traded iron ore contract, for September delivery, on China’s Dalian Commodity Exchange ended daytime trade 5.9% lower at 821.50 yuan ($122.64) a tonne, after earlier tumbling to 815.50 yuan, the lowest since May 26.

Mining stocks also slid, with Vale down almost 8% from the previous week, Rio Tinto down 7% and Fortescue down 12%.

“In recent weeks, an increasing number of mills in (China’s) steelmaking hub of Tangshan are opting to undertake maintenance and cut output amid weak margins,” said ANZ senior commodity strategist Daniel Hynes.

Some regions have also begun to actively curb production, analysts at Sinosteel Futures said.

The rainy season in many parts of China that usually disrupts construction activity and restrictions put in place to contain covid-19 outbreaks have hit demand in the world’s top steel producer, squeezing mills’ margins.

Reflecting such sluggish demand, China’s steel inventory has risen this week by 316,700 tonnes to about 22.2 million tonnes, according to Sinosteel analysts.

(With files from Reuters)

This post has been syndicated from a third-party source. View the original article here.