Mining

Monday, October 9th, 2023 11:08 pm EDT

Key Points

- Shortage of Copper Mines for Clean Energy Transition: The world’s largest copper producers are warning of a shortage of copper mines under development to meet the demand for the clean energy transition. This shortage is driven by various factors, including the weakness of the global economy, cost inflation, and labor shortages. Copper is crucial for manufacturing electric vehicles and upgrading the electricity grid, making it a vital component of the transition to carbon-free power.

- Challenges in Copper Production: Falling copper prices, partly due to a cooling global economy and increased production from new mines in Peru and Chile, are challenging mining companies. Executives, investors, and banks are cautious about financing new copper projects. Additionally, labor shortages are hampering the production of new copper supplies.

- Growing Demand for Copper: Despite current price declines, the demand for copper is expected to soar as it is essential for the green economy and the economic development of countries like India. Copper is used in various applications, and its importance will increase as the world embraces green technologies. Forecasts suggest that the copper market could double by 2035 compared to 2021 levels. However, there are concerns about a “chronic gap” between supply and demand.

- Copper producers are grappling with the challenge of generating enough large-scale projects due to the increasing difficulty of finding high quantities of copper in the ground. The reluctance to invest in projects with long development timelines, high costs, and political uncertainties is exacerbating the potential copper shortage. Some experts believe that there will be a need for innovation to substitute or reduce the use of copper in products. The supply crunch for metals like copper poses a dilemma between achieving decarbonization goals and addressing global poverty without policy intervention.

The world’s largest copper producers are sounding an alarm about a shortage of copper mines in development to meet the growing demand driven by the clean energy transition. This warning comes amid challenges faced by mining companies, including falling metal prices due to global economic weakness and cost inflation, which have made financiers cautious about funding new projects. Labor shortages are also hindering the production of new copper supplies, raising concerns about the transition to carbon-free energy, as copper is essential for electric vehicles and upgrading electrical grids.

Kathleen Quirk, President of Freeport-McMoran, the largest copper producer in the US, emphasized that higher copper prices alone won’t be sufficient to secure the necessary metal for global green initiatives. She pointed out that various factors beyond price will limit the pace of copper supply development, potentially prolonging the energy transition.

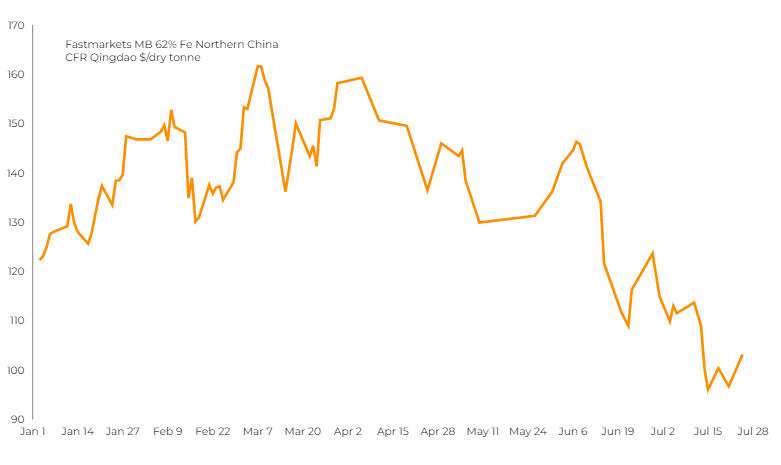

Copper prices have dropped by 4% this year, currently at around $8,000 per tonne, down from a peak of over $10,000 per tonne last year. This decline is attributed to a cooling global economy and increased production from new mines in Peru and Chile.

However, demand for copper is expected to surge to support the green economy and the economic growth of countries like India. Copper is essential for various applications, with the average Westerner’s living standards requiring 200-250 kilograms of copper per person, compared to a global average of 60 kilograms. Copper is used in electrical wiring, household appliances, and infrastructure like trains.

As the world transitions to green energy, copper is often referred to as the “metal of electrification.” Forecasts suggest that the copper market could double to a 50 million-tonne market by 2035 compared to 2021 levels. S&P Global predicts a significant gap between supply and demand.

Mining executives are hesitant to invest in large copper projects due to extended development timelines of 10-15 years and costs running into billions of dollars. Low copper prices, political uncertainties in mining jurisdictions, longer permitting timelines, higher inflation, and declining ore body grades add to the complexity of investing in new copper mines.

Copper producers are increasingly resigned to potential shortages later this decade, leading to innovation aimed at substituting or reducing copper usage in products. However, the extent to which such innovations can mitigate the shortage remains uncertain.

The supply crunch for metals like copper poses a challenge, potentially requiring a trade-off between achieving decarbonization goals and addressing global poverty, prompting discussions about the need for policy interventions to balance these priorities.

For full original article, please click here: https://www.ft.com/content/b3ad2631-f8b9-41df-8e2e-b4493738ded8