Mining

Thursday, September 8th, 2022 8:13 am EDT

Copper for delivery in December rose 2.6% from Wednesday’s settlement price, touching $3.52 per pound ($7,744 per tonne).

The most-traded October copper contract on the Shanghai Futures Exchange increased 0.6% to 61,330 yuan ($8,801.66) a tonne.

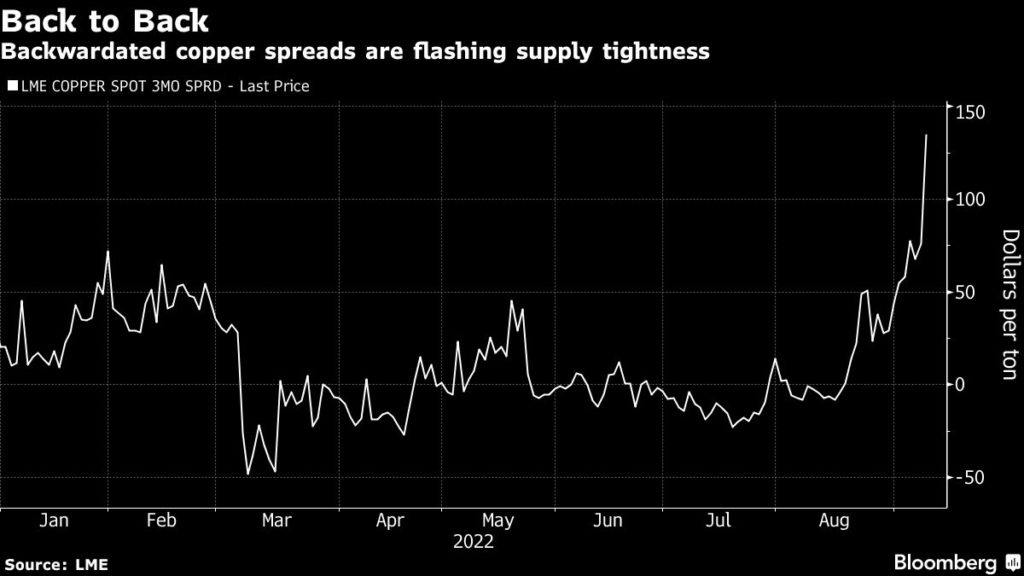

The premium for cash copper over three-month futures on the London Metal Exchange rose by as much as 91% on Thursday to a high of $145 per tonne, an indication the market is paying more for units right now. That’s the biggest backwardation since November last year.

[Click here for an interactive chart of copper prices]

“It doesn’t feel to me that anyone wants to be caught short on a price rally because the physical market is actually very strong,” Michael Widmer, head of metals research at Bank of America told Bloomberg.

“Europe is spending as much as possible on grids and renewables to become energy independent from Russia and China’s doing the same for de-carbonization reasons.”

Indonesian President Joko Widodo reiterated on Wednesday that the country will stop exporting raw copper, bauxite, and tin to encourage foreign investment and help the country jump up the value chain in resource processing.

China imported 26% more copper in August than a year earlier, customs data on Wednesday showed.

“Lower copper prices in July and August sparked buying activities. Also, the open arbitrage between Shanghai and London led to more cargos inflow,” said He Tianyu, a copper analyst at CRU Group.

(With files from Reuters and Bloomberg)

This post has been syndicated from a third-party source. View the original article here.