Mining

Monday, July 1st, 2024 3:47 pm EDT

Key Points

- Copper powers essential AI technologies, with companies like Nvidia relying on it for their data centers. As AI grows, copper demand increases.

- Electric vehicles and renewable energy rely on copper. EVs use four times more copper than traditional cars. Wind turbines and solar panels also depend on copper, driving its demand.

- Copper supply struggles to meet demand. Analysts predict a deficit by 2030, creating investment opportunities. Institutional investors and strategic partnerships seek stable copper supplies.

- Manning Ventures’ (CSE:MANN) (US:MANVF) Copper Hill Project in Nevada, is surrounded by several deposits, and offers a significant growth opportunity. As copper demand surges, projects like Copper Hill highlight the importance of copper exploration and the critical need to increase supply.

Stock CARD

Manning Ventures Inc.

Stay up to date and subscribe to gain free access to educational insights.

By subscribing, you consent to us keeping you informed about updates to our website and about other products and services that we think might interest you. You can unsubscribe at any time. Please read our Privacy Policy and Terms of Use.

Copper is having a moment. It’s not flashy or headline-grabbing like AI, but it’s quietly powering the revolution.

Artificial Intelligence (AI) is a leading headline in 2024, as it revolutionizes industries and reshapes the very ways in which we work. From predictive analytics to autonomous systems, AI technologies rely heavily on the seamless transmission of vast amounts of data. For every surging AI market leader, there are dozens of manufacturers and suppliers that have grown into increasingly impressive market shares of their respective industries.

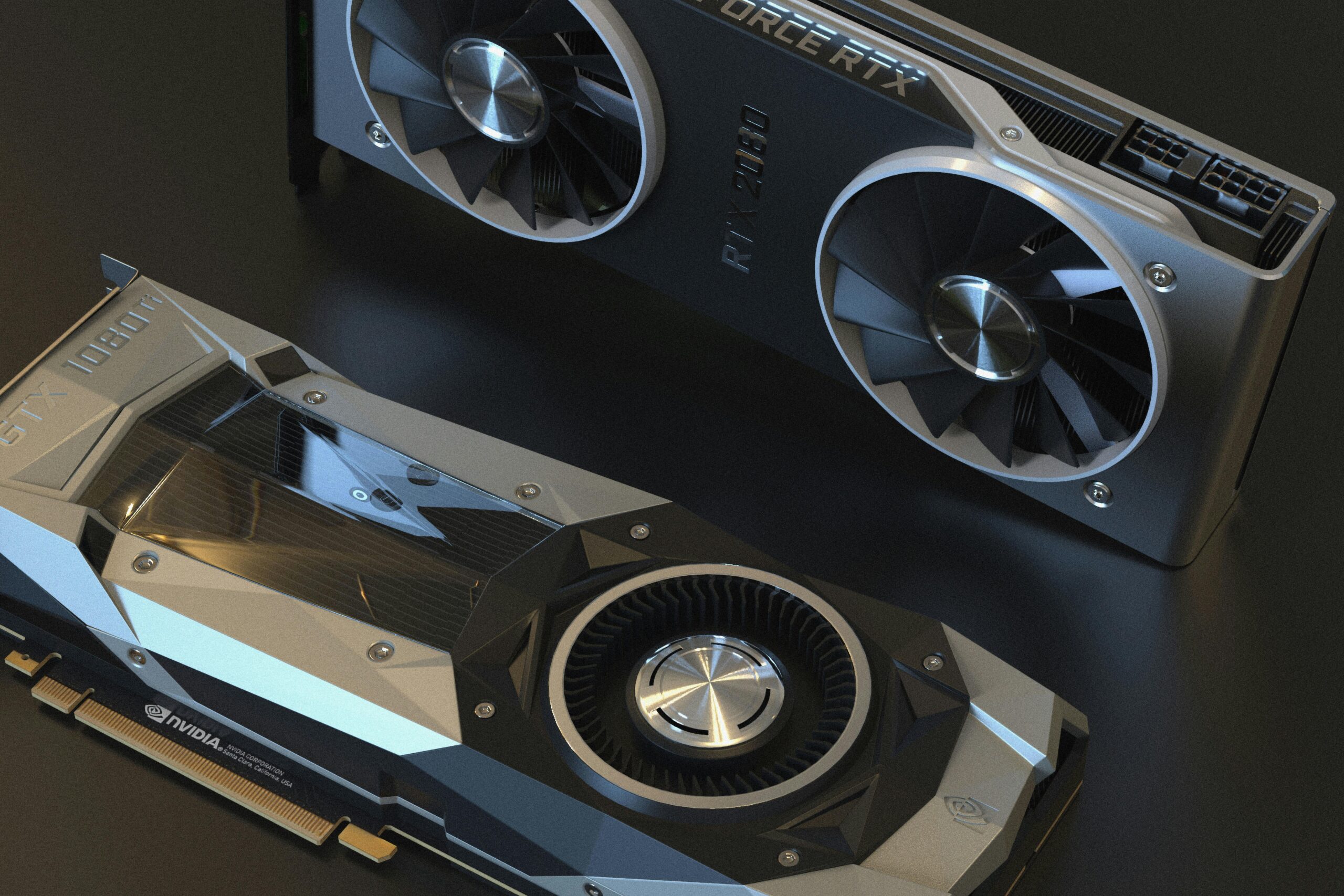

These were the stocks that drove a global market surge in early 2024, and now hold their

posts at the top of the markets. At the forefront stand industry titans like Nvidia (Nasdaq:NVDA), whose cutting-edge graphics processing units (GPUs) power some of the most advanced AI systems in existence. Groups like Applied Materials (Nasdaq: AMAT) have grown exponentially as providers of microprocessors and materials to fuel companies like Nvidia.

To peel the onion once more, these processors and GPUs are intricately woven with copper wiring and components, serving as the lifeblood of AI infrastructure, enabling rapid data processing and analysis on an unprecedented scale.

As AI technologies permeate deeper into our daily lives, the demand for copper escalates in tandem. Data centers, the backbone of our digital infrastructure, rely extensively on copper wiring and cabling to facilitate the rapid transmission of colossal volumes of data. Nvidia’s data centers, in particular, exemplify this reliance on copper, serving as the nerve center of AI innovation and research.

Moreover, the convergence of AI with other transformative technologies, such as electric vehicles (EVs) and renewable energy sources, further amplify the demand for copper. EVs, which utilize up to four times more copper than traditional gas-powered vehicles, lean heavily on copper for their batteries and motors. Renewable energy infrastructure, such as wind turbines and solar panels, rely on copper for efficient power transmission and energy storage.

As the world races to embrace the opportunities presented by AI, the importance of copper as a foundational element in these technologies cannot be overstated.

Clean Tech & Energy Generating Major Market Shift

Copper is not merely a commodity; it is a driving force in the transition towards renewable energy sources. It serves as an indispensable element for renewable power generation, powering wind turbines, solar panels, and batteries. Furthermore, it remains essential for electrical wiring within the grid infrastructure. The burgeoning global power grid capacity, slated to double by 2050 to accommodate heightened electricity demand, necessitates an additional 427 million metric tons of copper.

Moreover, copper assumes a pivotal role in the realm of electric vehicles (EVs), serving as a key component in EV batteries and motors. EVs harness up to four times more copper than their gas-powered counterparts, reflecting the critical role copper plays in the future of transportation. Notably, the largest economies in the world are steadfastly transitioning towards EVs and renewables. China, for instance, now produces twice as many electric vehicles as gas-powered cars, while demand for EVs in India has surged to unprecedented levels.

Furthermore, the advent of Artificial Intelligence (AI) heralds a surge in electrical demand, intensifying the reliance on nuclear and battery grid technologies. As development of AI accelerates, the need for copper amplifies, further propelling its demand trajectory.

Stock CARD

Manning Ventures Inc.

Stay up to date and subscribe to gain free access to educational insights.

By subscribing, you consent to us keeping you informed about updates to our website and about other products and services that we think might interest you. You can unsubscribe at any time. Please read our Privacy Policy and Terms of Use.

Copper Supply Constraints

The heightened demand for copper unfolds against the backdrop of constrained supply. Despite miners ramping up copper production annually for two decades, supply appears unable to keep pace with the unprecedented surge in demand. Analysts, initially projecting a copper deficit to emerge in the late decade, are now revising their forecasts. Mine disruptions and lower production guidance have accelerated this timeline, with some analysts foreseeing a deficit as early as this year. Goldman Sachs, for instance, anticipates a deficit of 5 million metric tons by 2030, underscoring the imminence of supply-demand imbalances within the copper market.

Investment Landscape

Copper investments are gaining traction as investors recognize its pivotal role in powering exciting technologies. From established mining companies expanding operations to startups exploring untapped reserves, copper investments are vibrant and dynamic.

Institutional investors are increasingly allocating capital to copper-focused funds and projects, drawn by potential long-term growth and stability. Strategic partnerships between tech giants and copper producers, like Nvidia’s collaboration with mining companies, highlight copper’s significance in driving the digital age.

As the world transitions to a greener, more advanced future, major copper investments stand poised to deliver substantial returns.

Untapped Markets

Investing in mining exploration presents a compelling opportunity for investors seeking exposure to the commodities market. Unlike investing directly in commodities themselves, which can be subject to price volatility and cyclical fluctuations, investing in mining exploration offers the potential for substantial profit potential as new mineral deposits are discovered and developed. By backing exploration projects with strong potential, investors can capitalize on the early stages of resource discovery, often at a fraction of the cost of acquiring established mining assets.

Additionally, investing in mining exploration allows investors to diversify their portfolios and gain exposure to a wide range of commodities, including copper, gold, uranium, and lithium, among others.

Investing in mining exploration offers a strategic approach to accessing the inherent value of commodities while mitigating some of the risks associated with direct commodity investments.

Latest News in Copper Exploration

Nestled in one of the world’s most renowned copper-producing regions, Manning Ventures (CSE:MANN) (US:MANVF) is spearheading the development of the Copper Hill copper project, a venture poised to redefine exploration excellence in the growing energy sector.

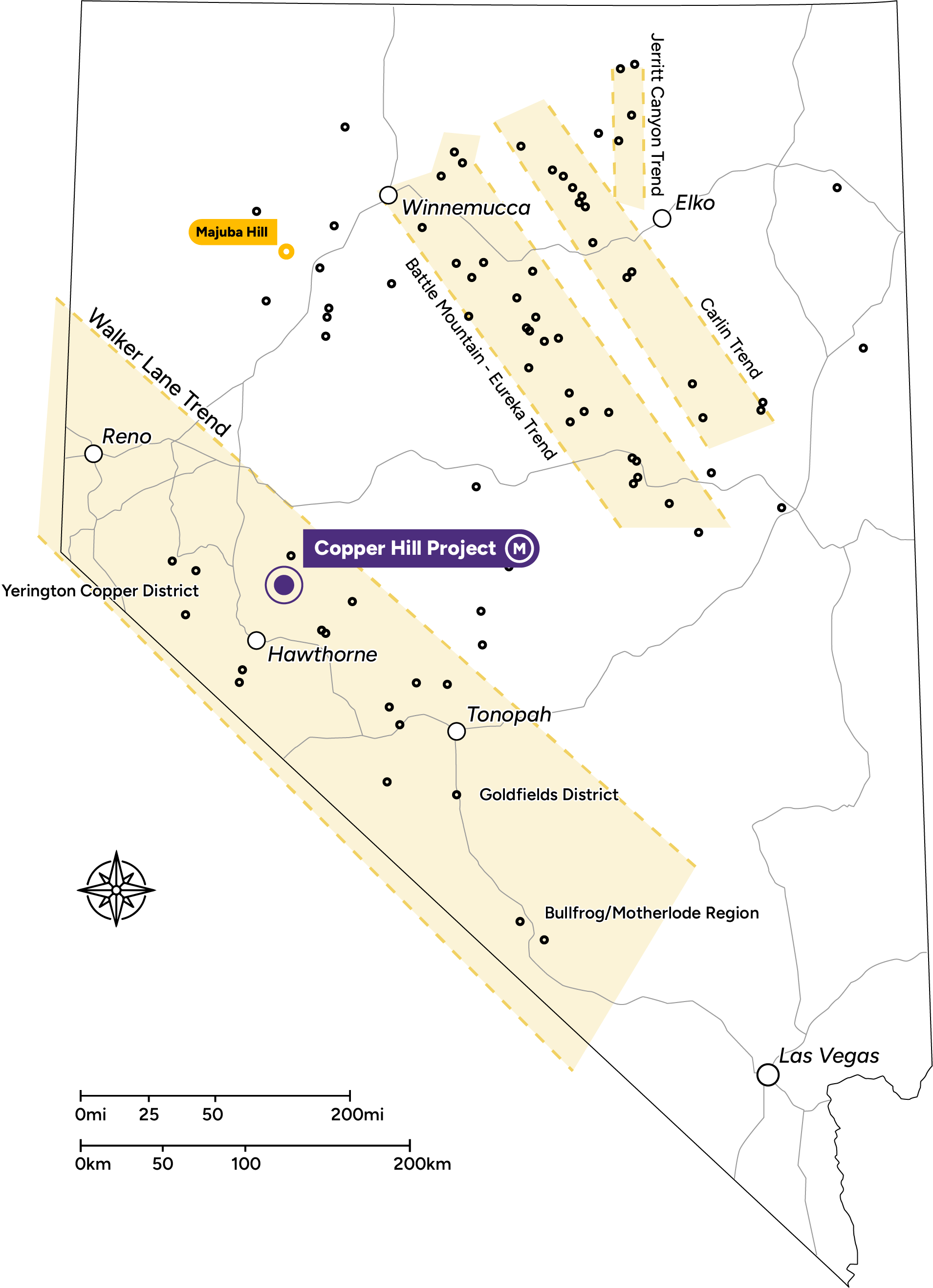

The Copper Hill Project is strategically situated in Nevada, within the mineral-rich Walker Lane Belt—an expanse spanning over 75 miles wide and extending along Nevada’s western frontier for over 300 miles. Within a 50-mile radius of Copper Hill lies a nexus of activity, with 13 active copper and gold mines and exploration projects dotting the landscape. Notably, five of these projects are copper porphyry deposits nestled within the Yerington District, including the Yerington Mine, MacArthur, Bear, Ann Mason, and Pumpkin Hollow.

Yerington District: A Nexus of Potential:

The Yerington District, located approximately 30 miles west of Copper Hill, stands as a focal point of copper exploration and development activity. The open-pit Yerington Mine, operational from 1952 to 1978 under Anaconda Copper, is now under exploration by Lyon Copper and Gold in a joint venture with Rio Tinto. The Yerington Mine alone boasts a production legacy of 1.7 billion pounds of copper, with plans for future drilling in the historic pit rumored for 2024.

Additionally, the Bear Deposit, harboring over 500 million tons grading at 0.4% copper, presents an enticing prospect for future development. Meanwhile, MacArthur is poised for advancement towards mine development, with recent resource estimates outlining significant potential.

Ann Mason and Pumpkin Hollow: Charting New Frontiers:

Further afield, the Ann Mason deposit, owned by Hudbay Minerals, emerges as one of the largest Greenfield copper projects in the Americas. With a resource estimate of 2.2 billion tonnes and a preliminary economic assessment (PEA) delineating a robust mine plan, Ann Mason exemplifies the immense potential of the Yerington District.

Meanwhile, Pumpkin Hollow, an active underground mine in the heart of the Yerington District, boasts substantial mineral reserves and an extension potential underscoring its significance as a cornerstone of the region’s copper landscape.

The Manning Advantage:

Amidst this landscape of opportunity, Manning Ventures’ (CSE:MANN) (US:MANVF) Copper Hill Project stands out as a beacon of promise. With a tight capital structure, bolstered by a substantial cash position, and a portfolio of prospective projects, Manning Ventures is poised to unlock significant value in the critical energy space. As the demand for copper surges and supply constraints intensify, the Copper Hill Project represents an unparalleled opportunity for investors seeking exposure to the burgeoning copper market.

Join us as we embark on this journey of exploration and discovery, charting new frontiers in copper exploration and development. As Manning Ventures (CSE:MANN) (US:MANVF) continues to explore its asset and prepares for its inaugural drill program, the potential for a true discovery is what makes this play so exciting.

TL;DR

Investing in Nvidia ahead of the AI boom would have been a powerful play, just like investing in Applied Materials during the AI growth period would have yielded massive returns.

It’s easy to look at the recent surges in AI and component hardware stocks and feel like you’ve missed the boat.

But behind the flashiest growth stocks are the true horses.

Behind the AI revolution was a rapid growth in processing power, fueled by a reliance on copper materials. As that reliance continues to grow, invest in Manning Ventures copper exploration to leverage a moment where limited supply is met with continuously increasing demand.

Disclaimer

Forward-Looking Statements and Legal Disclaimers – Please Read Carefully.

The information contained in this article does not constitute or form part of, and should not be construed as, an offer or invitation to subscribe for or purchase the securities discussed herein in any jurisdiction. Neither this article nor any part of it shall form the basis of, or be relied upon in connection with any offer, or act as an inducement to enter into any contract or commitment whatsoever. No representation or warranty is given, express or implied, as to the accuracy of the information contained in this article.

The information contained herein has been prepared to assist the recipients in making their own evaluation on the Company and does not purport to contain all information that they may desire. In all cases, the recipients should conduct their own investigation and analysis of the Company, its business, prospects, results of operations and financial condition as well as any other information the recipients may deem relevant.

This article contains forward-looking statements, which relate to future events or future performance and reflect management’s current expectations and assumptions. Such forward-looking statements reflect management’s current beliefs and are based on assumptions made by and information currently available to the Company. Investors are cautioned that these forward-looking statements are neither promises nor guarantees and are subject to risks and uncertainties that may cause future results to differ materially from those expected. These forward-looking statements are made as of the date hereof and, except as required under applicable securities legislation, the Company does not assume any obligation to update or revise them to reflect new events or circumstances. All forward-looking statements made in this article are qualified by these cautionary statements and by those made in our filings with SEDAR in Canada (available at www.sedar.com).

None of the information contained herein or supplied herewith or subsequently communicated in written, electronic or oral form to any person in connection with the contemplated issue of shares in the Company constitutes, or shall be relied upon as constituting, the giving of investment advice to any such person. Each person should make their own independent assessment of the merits of investing in the Company and should consult their own professional advisors. By receiving this presentation, you acknowledge and agree that you will be solely responsible for your own assessment of the market and the market position of the Company and that you will conduct your own analysis and are solely responsible for forming your own opinion of the potential future performance of the Company’s business.

This article contains certain forward-looking statements within the meaning of applicable securities laws. All statements that are not historical facts, including without limitation, statements regarding future estimates, plans, programs, forecasts, projections, objectives, assumptions, expectations or beliefs of future performance, are forward-looking statements. Forward-looking statements in this material include that copper will be the preferred commodity source for the future artificial intelligence; that the market for copper will continue to grow substantially; that the market for artificial intelligence technologies will continue to grow substantially; that the demand for copper will continue to grow substantially; that the global market for copper will continue to grow; that there will be a global supply crisis for copper; that Manning Ventures Inc. (the “Company”) will become a world-leading company of the future; that the Company will successfully implement its plan to explore and develop its Copper Hill copper project; that the Company can successfully explore and develop its properties for copper production; that management’s previous experience will allow the Company to achieve commercial success and implement its business plans; that the Company will achieve similar exploration and development success on its properties as was achieved on adjacent properties; that the Company will become a world-leading copper company. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that copper fails to become a preferred commodity used in the future of artificial intelligence technologies; that the market for copper fails to grow as expected due to alternative commodities or technologies; that the demand for copper does not increase as anticipated due to various reasons; that the copper market may not grow as expected due to competing technologies and resources; that political mandates in Canada, United States and elsewhere may result in market reductions for copper; that the global market for copper may not grow as anticipated or that alternative resources will be preferred; that there may fail to be a global supply crisis for copper; that copper may decline in use for the technology industry; that the Company may fail to achieve success for various reasons, including if the Company’s property may fail to have positive exploration results and the Company’s business model may be unsuccessful; that the Company may be unable to develop its copper asset if its drill program does not receive successful results ; that the Company may fail to generate any revenue from its mineral properties and may lose money; that the Company’s property may not have commercial copper; that the Company may be unable to implement its plan to successfully drill for copper; that the Company may be unable to utilize any political connections, favorable geographic location or other factors to achieve success; that management’s previous experience may not result in future success; the Company may have no copper reserves and fail to achieve similar results as adjacent properties; that the Company may suffer negative and unforeseen consequences from the COVID-19 pandemic or future pandemics; that the Company may ultimately fail to successfully implement its business plans, raise capital or generate any significant revenues. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

Readers are cautioned that this article contains quoted historical exploration results. These are derived from filed assessment reports and compiled from governmental databases. The Company and a QP have not independently verified and make no representations as to the accuracy of historical exploration results: these results should not be relied upon. Selected highlight results may not be indicative of average grades.

This article contains information concerning mineral properties in proximity or adjacent to the Company’s properties. Deposits, mineralization or historical results on such nearby or adjacent properties is not necessarily indicative of mineralization or similar grades on the Company’s properties.

LEGAL DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. The Investor’s Edge and its owners, managers, employees, and assigns has been paid for by Manning Ventures Inc. (the “Company”) for an ongoing marketing campaign including this article, among other things. This compensation is a major conflict with our ability to be unbiased. This communication is for entertainment purposes only. Never invest purely based on our communication.

NOT AN INVESTMENT ADVISOR. The Investor’s Edge and its principals and agents are not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation.

ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock trade will or is likely to achieve profits. Comparisons made to other featured companies or past performance is not indicative of future results.