US Markets

Friday, October 13th, 2023 1:46 pm EDT

Key Points

- Earnings and Revenue: Citigroup reported earnings per share of $1.63, which, due to divestitures, was not directly comparable to the expected $1.21. Excluding divestitures, earnings per share were $1.52. Revenue came in at $20.14 billion, outperforming the expected $19.31 billion, showing growth of 9% and 2% in revenue and net income, respectively, compared to the previous year.

- Business Segment Performance: Citigroup’s institutional clients unit reported $10.6 billion in revenue, marking a 12% increase year-over-year and 2% from the second quarter. The personal banking and wealth management division generated $6.8 billion in revenue, reflecting growth of approximately 10% year-over-year and 6% from the second quarter.

- CEO’s Statement: CEO Jane Fraser noted that despite challenges, all five core interconnected business segments posted revenue growth, resulting in an overall 9% growth in revenue. This performance was well-received by investors, with Citigroup’s stock rising more than 2% in early trading.

Citigroup’s third-quarter financial results have showcased strong growth in its institutional and personal banking sectors, surpassing Wall Street’s expectations and generating higher-than-anticipated revenue. Here’s a comprehensive analysis of the key points and implications of Citigroup’s Q3 report:

1. Earnings and Revenue Beat Expectations:

- Citigroup reported earnings per share of $1.63, exceeding Wall Street’s projections. However, it’s worth noting that these earnings are not directly comparable to the expected figure of $1.21 due to divestitures. When excluding the impact of divestitures, Citigroup’s earnings per share stood at $1.52.

- The bank’s revenue for the quarter reached $20.14 billion, outperforming the anticipated revenue of $19.31 billion.

2. Strong Revenue and Net Income Growth:

- Citigroup exhibited robust revenue and net income growth, with both metrics rising by 9% and 2%, respectively, compared to the previous year. This signifies the bank’s capacity to generate higher income and maintain profitability even in a challenging economic environment.

3. Performance in Key Business Units:

- Citigroup’s institutional clients unit reported impressive results, with $10.6 billion in revenue, marking a remarkable 12% increase year-over-year and a 2% uptick from the second quarter. This robust performance in the institutional clients segment reflects the bank’s effectiveness in addressing the needs of corporate clients and institutional investors.

- The personal banking and wealth management division also generated noteworthy revenue of $6.8 billion, exhibiting substantial growth of approximately 10% year-over-year and 6% from the previous quarter. This is indicative of Citigroup’s success in serving the financial needs of individual customers and high-net-worth clients.

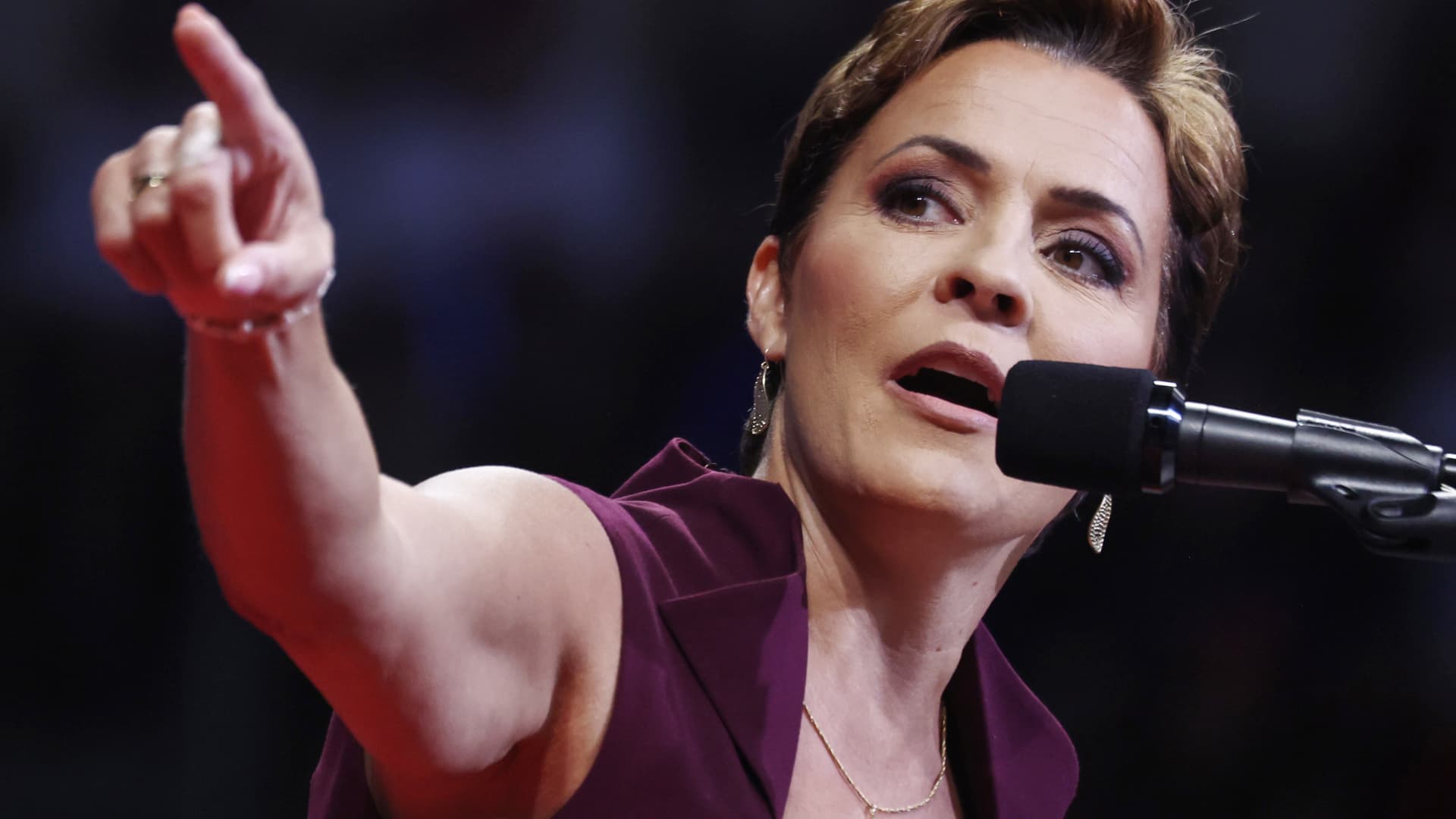

4. CEO Jane Fraser’s Perspective:

- Citigroup’s CEO, Jane Fraser, emphasized the bank’s resilience in the face of challenges, stating that despite the headwinds, the five core, interconnected business segments each achieved revenue growth, resulting in an overall growth rate of 9%. This highlights the bank’s ability to adapt and thrive in a dynamic financial landscape.

5. Positive Market Reaction:

- Following the release of the earnings report, Citigroup’s stock experienced a more than 2% increase in early trading. This suggests that investors reacted positively to the bank’s performance, appreciating the earnings beat and the growth in key business segments.

6. Comparisons with Other Banks:

- Citigroup’s strong performance in the third quarter aligns with the trend seen in other major banks. Banks like JPMorgan and Wells Fargo also reported revenue figures that exceeded expectations, indicating a broader trend of resilience and profitability in the banking sector.

7. Total Cost of Credit:

- Citigroup reported a total cost of credit of $1.84 billion at the end of the quarter, which is slightly up from $1.82 billion at the end of the second quarter and $1.37 billion a year ago. This metric includes a net build of $125 million in the allowance for credit losses during the third quarter. The increase in the total cost of credit is a notable aspect to watch in Citigroup’s financial health.

8. Reorganization under CEO Jane Fraser:

- Citigroup’s earnings report covers the period during which CEO Jane Fraser announced a significant reorganization of the bank. Under this reorganization, Citigroup will be divided into five main business lines. This move represents the latest change since Fraser assumed the role of CEO in March 2021 and is expected to include job cuts. Investors will be looking for further details about this reorganization in Citigroup’s conference call.

9. International Retail Banking Business Sales:

- Another strategic initiative under CEO Jane Fraser has been the divestment of Citigroup’s retail banking business in certain international markets. The most recent development in this regard occurred on October 9 when the bank announced a deal to sell its onshore consumer wealth portfolio in China. This aligns with Citigroup’s ongoing efforts to streamline its operations and focus on core business areas.

In summary, Citigroup’s Q3 results have demonstrated the bank’s ability to achieve strong growth in revenue and net income, driven by robust performances in both institutional clients and personal banking segments. This performance aligns with the broader trend of resilience and profitability observed in the banking sector. The bank’s ongoing reorganization and international business divestments under CEO Jane Fraser signify strategic moves to streamline operations and enhance efficiency. The positive market reaction reflects investor confidence in Citigroup’s ability to navigate economic challenges effectively.

For full original article on CNBC, please click here: https://www.cnbc.com/2023/10/13/citigroup-c-q3-earnings-report-2023.html