Mining

Sunday, September 11th, 2022 1:22 pm EDT

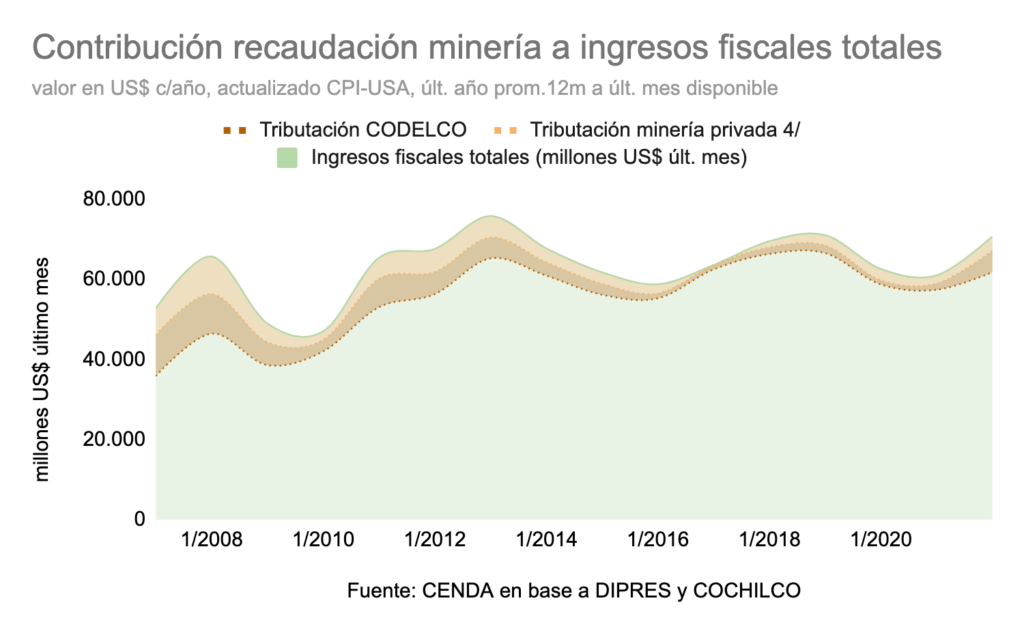

To reach these conclusions, the think-tank used the ‘royalty equivalent’ measure, which indicates the proportion of each ton of copper produced that should go to taxes.

“Total taxation of private companies is equivalent to less than a tithe of the value of each ton extracted. Codelco’s is equivalent to about a third of the value of each ton extracted,” the report reads. “Thus, the gigantic subsidy received by private mining companies becomes evident.”

According to the CENDA, the lower ‘royalty equivalent’ paid by private mining compared to Codelco has represented an additional benefit of nearly 100 billion dollars for these companies, since 2006.

This post has been syndicated from a third-party source. View the original article here.