US Markets

Thursday, November 30th, 2023 2:53 pm EDT

Key Points

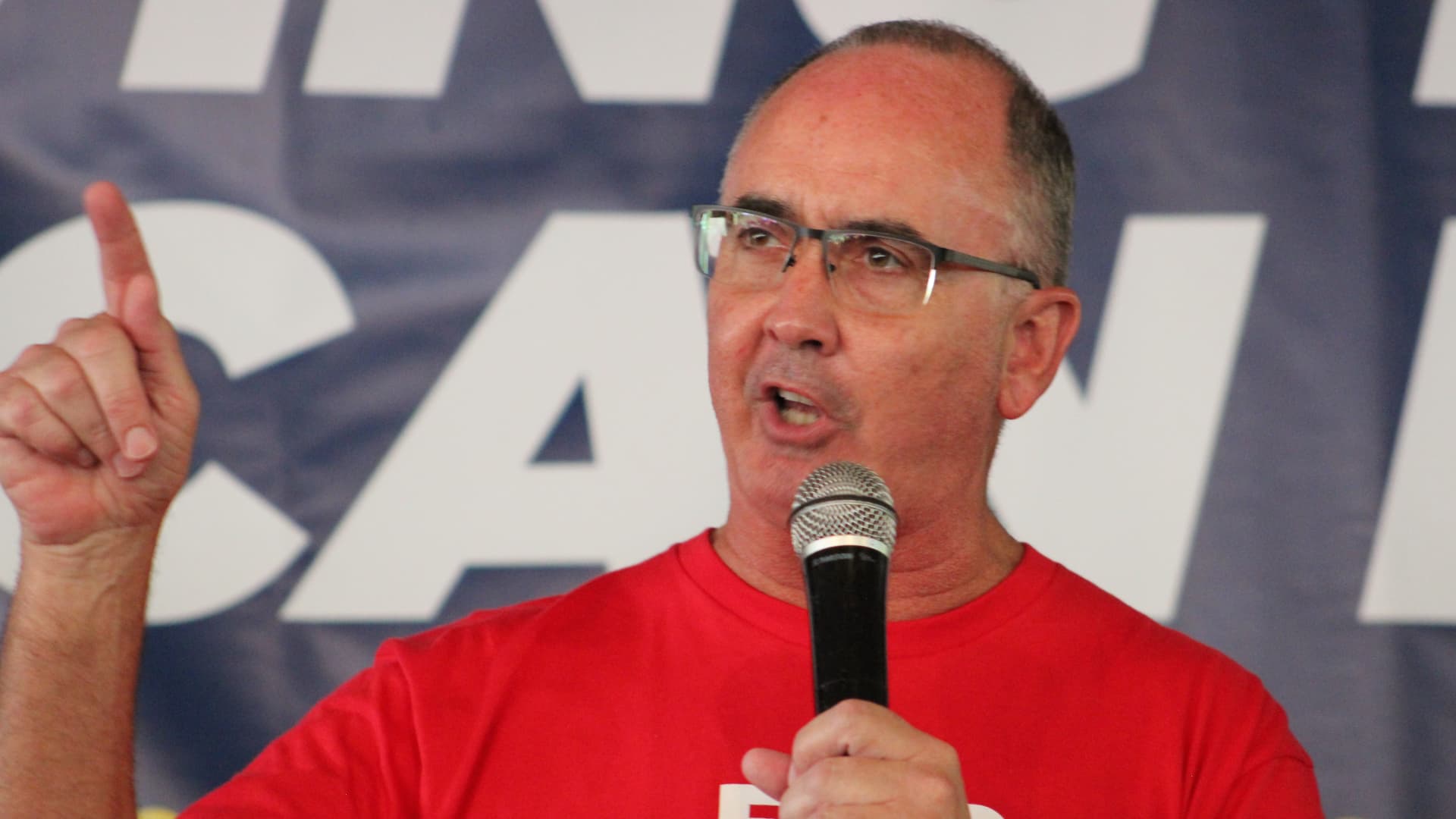

- Trian’s Bid for Disney Board Seats: Activist investor Nelson Peltz and his firm, Trian Fund Management, are reportedly seeking more than two seats on Disney’s board, indicating a potential proxy fight. Trian expressed its intention to present the case for change directly to shareholders after Disney rejected its bid to join the board, a move that sets the stage for a contentious battle over board representation.

- Disney’s Response and Recent Board Additions: Disney responded by suggesting that the proxy fight may stem from a personal grudge held by former Marvel boss Ike Perlmutter, an ally of Peltz. Trian revealed that Disney offered a meeting with the board but rejected its bid, without specifying the number of seats it plans to seek. The news followed Disney’s addition of Morgan Stanley CEO James Gorman and former Sky TV boss Jeremy Darroch to its board, viewed as a preemptive measure to counter a potential challenge from Peltz.

- Ongoing Dynamics and Investor Concerns: Trian, holding around $3 billion in Disney stock, criticized the recent board additions, stating that while Gorman and Darroch represent an improvement, they won’t address the root cause of significant value destruction overseen by Disney’s current board. Disney shares, up about 6% for the year, underperformed the S&P 500. Trian highlighted its oversight of shares owned by former executive Ike Perlmutter, a vocal critic of Disney CEO Bob Iger, terminated earlier in the year. Disney countered by suggesting that Perlmutter’s personal agenda against Iger may differ from other shareholders, emphasizing the dynamics relevant to assessing Peltz and any potential nominees for board positions.

Activist investor Nelson Peltz and his firm, Trian Fund Management, are reportedly seeking more than two seats on Disney’s board, potentially leading to a proxy fight. Trian announced its intention to take its case for change directly to shareholders after Disney rejected its bid to join the board, including the addition of Peltz. While Disney suggested the proxy fight may be driven by a personal grudge held by former Marvel boss Ike Perlmutter, an ally of Peltz, Trian countered by stating that Disney had offered a meeting with the board but rejected Trian’s bid.

The news follows Disney’s recent addition of Morgan Stanley CEO James Gorman and former Sky TV boss Jeremy Darroch to its board, seen as a move to preemptively fend off a potential challenge from Peltz. Despite these additions, Trian expressed dissatisfaction, stating that while the new directors represent an improvement, they would not address the root cause behind the significant value destruction and missteps overseen by Disney’s current board.

Trian, holding approximately $3 billion in Disney stock, has a history of involvement with the entertainment giant. Former executive Ike Perlmutter, a critic of Disney Chief Bob Iger, owns 78% of the shares claimed as beneficial ownership by Peltz. Perlmutter, terminated by Disney earlier in the year, has a longstanding personal agenda against Iger, citing concerns that Disney had overspent.

Disney fired back, highlighting the personal dynamics between Peltz and Perlmutter, suggesting that their motivations may differ from those of other shareholders. The statement emphasized Perlmutter’s termination and his vocal dissatisfaction with Disney’s spending decisions.

This development marks a renewed push by Peltz, who had earlier sought a board seat after Trian invested approximately $800 million in Disney. After Disney’s restructuring announcement in February, which included layoffs and cost cuts, Peltz temporarily backed off from a proxy fight. However, the activist investor has revived his efforts, with the decision influenced by Disney’s recent quarterly earnings report.

Disney CEO Bob Iger, in response to the potential challenge, reaffirmed his focus on rebuilding. He outlined plans to concentrate efforts on theme parks, the upcoming ESPN streaming service, and improving the studio business. The ongoing dynamics between Trian and Disney’s leadership underscore the complexities of shareholder activism and the strategic decisions made by major corporations in response to such challenges.

For the full original article on CNBC, please click here: https://www.cnbc.com/2023/11/30/nelson-peltz-seeks-two-seats-on-disney-board.html