Mining

Monday, October 30th, 2023 2:28 pm EDT

Key Points

- McEwen Mining Production and Forecast: McEwen Mining reported its production figures for Q3 2023, with a total of 38,600 gold equivalent ounces (GEOs). The cumulative production for the first nine months of 2023 reached 104,800 GEOs. The company intends to maintain its consolidated production guidance for 2023, despite Gold Bar Mine’s production forecast being 13% below the guidance range. Various factors, including flooding, extreme weather, and a slower leach recovery rate, have contributed to this variance.

- Operational Updates on Gold Bar Mine, Fox Complex, and San Jose: Gold Bar Mine in Nevada made significant progress, recovering from a challenging first half of the year. Notably, it achieved a consistent increase in production quarter after quarter and maintained an excellent safety record. At the Fox Complex in the Timmins District, Q3 performance was strong, with the operation on track to slightly exceed the mid-point of its guidance range. Additionally, good exploration drilling results were reported at the Stock Complex. San Jose in Argentina, operated by joint venture partner Hochschild Mining, delivered Q3 production in line with expectations.

- McEwen Copper Developments: McEwen Copper, a subsidiary of McEwen Mining, secured additional investments from Stellantis and Nuton, totaling ARS$42 billion and US$10 million, respectively. These investments contributed to McEwen Copper’s market value of approximately $800 million. McEwen Mining retained a 47.7% ownership stake in McEwen Copper, with an implied market value of $380 million, representing significant value accretion for McEwen Mining shareholders. The funds raised will be used for advancing the feasibility study on the Los Azules project and other corporate purposes. There are currently 14 drill rigs on site at Los Azules, scaling up to 18 rigs for a drilling campaign targeting more than 45,000 meters to complete the planned feasibility study by Q1 2025.

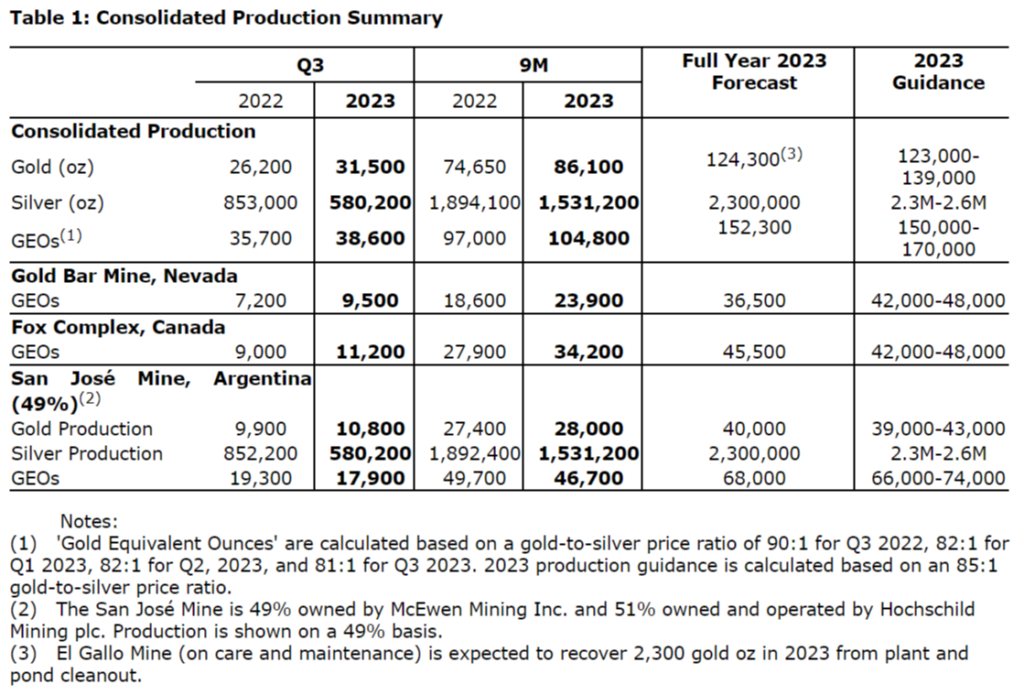

McEwen Mining Inc.’s production for Q3 2023 was 38,600 gold equivalent ounces (GEOs) and 104,800 GEOs for the nine months ended Sept. 30, 2023. The company’s consolidated production guidance for 2023 is maintained, despite the Gold Bar Mine’s production forecast being 13% below its guidance range. Our forecast for the full year 2023 (see Table 1) reflects actual productions to September 30th and management’s current estimates for Q4 2023.

Gold Bar Mine, Nevada

Good progress has been made at Gold Bar recovering from a challenging first half of the year, as demonstrated by steadily increasing production quarter after quarter. Gold Bar has also maintained an excellent safety record with 1,313 days without a lost time injury as of September 30th. Crushing and stacking of ore on the heap leach pad reached a rate of 9,300 tonnes per day (tpd) in September, a major improvement over the average in the prior eight months of 6,150 tpd. Year-to-date, ore containing 41,600 ounces of gold has been loaded onto the heap leach pad with an average expected recovery rate of 68%. Due to the gold inventory on the heap leach pad, we are confident in a reasonably strong Q4 continuing into the start of 2024. The 2023 production forecast is 13% below the guidance established in December 2022, due to a combination of factors including flooding and extreme weather in the Spring and a slower leach recovery rate of Gold Bar South ore.

Fox Complex, Timmins District

Fox performed well during Q3 and it is on track to slightly exceed the mid-point of our guidance range. Fox has achieved 738 days without a lost time injury as of September 30th. Mining at Froome is on track and the Stock mill continues to increase average throughput. We are pleased with the good exploration drilling results seen at our Stock Complex including the ‘Ramp Portal Zone’, which may represent an early mining horizon for our upcoming Stock West project (see news release dated October 3rd, 2023).

San Jos e, Argentina

San Jose, which is operated by our joint venture partner Hochschild Mining, delivered Q3 production in line with our expectations for the quarter and guidance for the year. San Jose reported one lost time injury in August 2023, the worker has since recovered and returned to regular duty.

McEwen Copper

On October 11th our McEwen Copper subsidiary announced additional investments by Stellantis and Nuton of ARS$42 billion and US$10 million, respectively. Since the creation of McEwen Copper, shareholders have invested $397 million (including investments by Stellantis in Argentine Pesos at official exchange rates at the time of each transaction) to acquire shares even though that the Company has remained private. The recent transactions occurred at $26.00 per share of McEwen Copper, giving it a market value of approximately $800 million. McEwen Mining retains 47.7% ownership of McEwen Copper, with an implied market value of $380 million, this represents a value accretion for McEwen Mining shareholders of $98 million or two (2) dollars per share since March 2023.

McEwen Copper is now well financed for the remainder of 2023 and well into 2024. The funds raised will be used to advance the feasibility study on the Los Azules project and for other corporate purposes. McEwen Mining also received proceeds of $6 million to augment its balance sheet.

Currently, we have fourteen drill rigs on site at Los Azules, scaling up to 18 drill rigs for our drilling campaign targeting more than 45,000 meters. This program will generate all the remaining data required to complete the planned feasibility study by Q1 2025.

Technical Information

The technical content of this news release related to financial results, mining and development projects has been reviewed and approved by William (Bill) Shaver, P.Eng., COO of McEwen Mining and a Qualified Person as defined by SEC S-K 1300 and the Canadian Securities Administrators National Instrument 43-101 “Standards of Disclosure for Mineral Projects.” Reliability of Information Regarding San Jose

Minera Santa Cruz S.A., the owner of the San Jose Mine, is responsible for and has supplied to the Company all reported results from the San Jose Mine. McEwen Mining’s joint venture partner, a subsidiary of Hochschild Mining plc, and its affiliates other than MSC do not accept responsibility for the use of project data or the adequacy or accuracy of this release.

ABOUT MCEWEN MINING

McEwen Mining is a gold and silver producer with operations in Nevada, Canada, Mexico and Argentina. In addition, it owns approximately 47.7% of McEwen Copper which owns the large, advanced stage Los Azules copper project in Argentina. The Company’s goal is to improve the productivity and life of its assets with the objective of increasing its share price and providing a yield. Its Chairman and Chief Owner has personally provided the company with $220 million and takes an annual salary of $1.

We seek Safe Harbor.