Mining

Friday, October 13th, 2023 3:55 pm EDT

Key Points

- Investor Interest in Gold Amid Economic Conditions: The article underscores that due to elevated interest rates and persistent inflation, many Americans are exploring alternative investment options. Gold, in various forms such as gold IRAs, gold ETFs, or physical gold, has gained popularity as an investment choice, particularly in the current economic climate.

- Uncertainty Surrounding Gold Prices in 2024: The article addresses the question of whether gold prices will rise in 2024. While acknowledging the inherent uncertainty in predicting future prices, it highlights historical trends. Gold prices typically exhibit seasonal variations, with the lowest prices in January and increases in February. It mentions that the largest price drops have been historically observed in months like March, June, and October. It provides an example of gold prices in April 2023, which saw a significant drop after nearing a record high.

- Key Considerations for Gold Investments: The article offers several important considerations for individuals interested in gold investments. It emphasizes that gold primarily serves as a wealth protector rather than an income-producing asset. Experts recommend limiting gold investments to 10% or less of one’s portfolio, with the specific allocation influenced by individual factors. The article also highlights the diversity of gold investment options, including gold IRAs, gold stocks, futures, and ETFs. Additionally, it dispels the misconception that gold investments are exclusively suited for seniors, emphasizing that gold can be valuable for investors of all ages when used appropriately.

The article explores the appeal of gold as an investment option in the context of elevated interest rates and persistent inflation, and it addresses whether gold prices are likely to rise in 2024. It also discusses various considerations for individuals interested in adding gold to their investment portfolios.

Gold as an Investment in Economic Uncertainty In a period characterized by increased interest rates and ongoing inflation, some Americans are seeking innovative investment opportunities. Gold has emerged as a popular alternative investment in 2023, with individuals considering options like gold IRAs, gold ETFs, or physical gold holdings. The precious metal has gained favor due to its perceived benefits in the current economic climate.

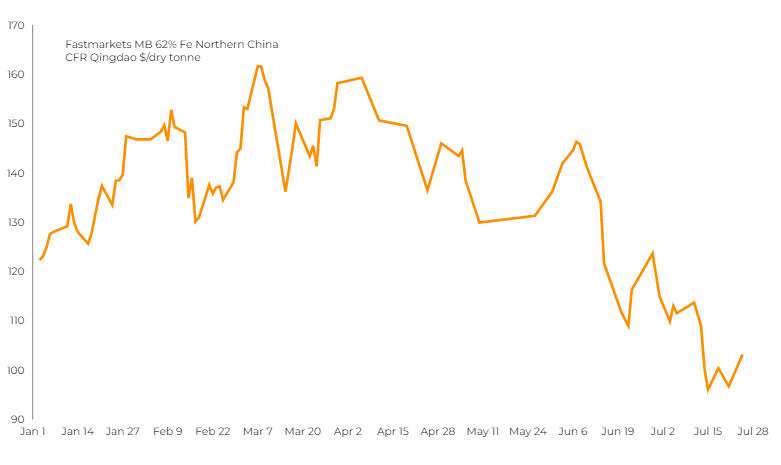

Uncertainty Surrounding Gold Prices in 2024 The article acknowledges that predicting the future prices of gold is inherently uncertain. However, historical performance can offer insights into potential trends. Historically, gold prices have exhibited seasonal variations, with the lowest prices typically occurring in January, followed by an uptick in February. Notably, the largest price drops have been observed in certain months such as March, June, and October.

An illustrative example is provided by the gold price in April 2023, which reached $2,048 per ounce, coming close to the record high of $2,067 established in August 2020. Subsequently, the price experienced a decline to $1,857 per ounce, approximately a 9% decrease. While this drop may be significant for some investors, it is characterized as consistent with gold’s historical price behavior.

Investor Considerations for Gold Investments Several key considerations are highlighted for individuals contemplating gold investments:

- Not an Income-Producing Investment: It is emphasized that gold primarily serves as a protector of wealth rather than an income-producing asset. Investors are urged to recognize this distinction before committing to gold investments.

- Portfolio Allocation Limits: Most experts recommend limiting gold investments to 10% or less of a portfolio. The specific allocation should be determined based on individual factors, including age and financial goals. Investors are encouraged to understand their portfolio specifications in advance.

- Diverse Investment Forms: Gold investments are not limited to physical bars and coins. They can take various forms, including gold IRAs, gold stocks, gold futures, or gold ETFs. Investors are advised to explore these options to maximize their returns.

- Gold for All Ages: The article dispels the misconception that gold is exclusively suitable for seniors and older adults. In the right amount and form, gold can be a valuable addition to the portfolios of investors of all ages, including beginners.

Conclusion While gold prices are currently lower, the article suggests that historical trends indicate the potential for prices to rise in the new year. This makes gold an attractive option for investors. Beyond the potential for buying low and selling high, gold can serve as a portfolio protector, irrespective of an investor’s age or long-term financial objectives.

For full original article on CBS, please click here: https://www.cbsnews.com/news/will-gold-prices-rise-in-2024/