Mining

Friday, September 30th, 2022 9:37 am EDT

Shares of NorZinc were trading at C$0.035 as of 12:30 ET, down 12.5% for the day. The company’s market capitalization stands at C$26.5 million.

“Considering the interests of all stakeholders in the company and its Prairie Creek project, and in order to maintain the current development work at and accessing the site, the board has explored all viable strategic alternatives,” CEO Rohan Hazelton said in a media release. “Ultimately, it has concluded that the unsolicited all-cash offer to the minority shareholders contained within the arrangement agreement is in the best interests of the company and its stakeholders.”

“While we believe this asset has an exciting future, given the current capital markets, debt and equity position of the company, we believe this is the best alternative for the company and its shareholders at the present time. We are proud of the recent milestones achieved in permitting and indigenous community agreements that have advanced Prairie Creek development and remain bullish on the long-term viability of the project and the positive impact it will have on the local region,” Hazelton said.

Concurrently with their agreement, NorZinc and RCF have amended their previous credit facility to provide for an increased funding commitment of $11 million to address the company’s near-term liquidity needs.

According to NorZinc, the company currently requires significant funding to advance Prairie Creek, particularly at this crucial point as major work on site and access development is in progress. It has been seeking funding to support its long-term business plan since early 2021, but has been unsuccessful to date.

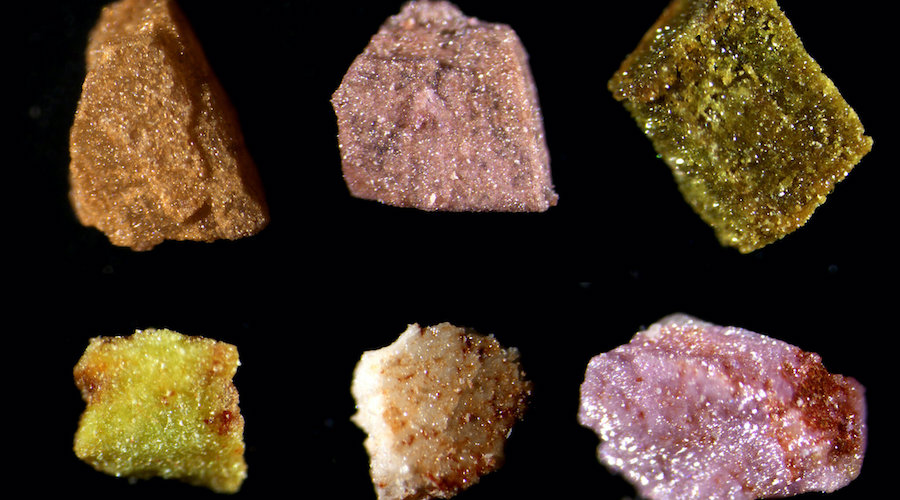

Located in traditional Dene territory, about 200 km west of Fort Simpson, the Prairie Creek property is home to what is regarded as one of Canada’s next large high-grade zinc-lead-silver mines.

A 2021 preliminary economic assessment for the project outlined a 20-year operation with average annual payable production of 122 million lb. of zinc, 101 million lb. of lead and 2.6 million oz. of silver. Its after-tax net present value (at 8% discount) is estimated at $299 million, with an internal rate of return of 17.7% and a payback period of 4.8 years.

Earlier this week, the Prairie Creek project finally completed its permitting process after a year-long delay, placing the mine on track for production by the end of 2025. NorZinc recently began preparations for the construction of an all-season road that will act as the main point of access to the mine site.

This post has been syndicated from a third-party source. View the original article here.